Many financial advisors have a lot of competition in the financial marketing industry. Whether it’s whole agencies or individuals competing to get their place at the top of the rankings, it all comes down to which firm can market itself the best: who can develop a long-lasting influence and attract the most clients while offering excellent service and dependability.

There are several financial advisor marketing ideas and strategies that can be used in order to help you develop a successful marketing campaign.

What Can Marketing Do for Me as a Financial Advisor?

The purpose of marketing is to set your business or self apart from the competition. The goal of marketing as a consultant is to demonstrate potential or existing clients that you know what you’re doing and how to get things done correctly. Demonstrating that you can be trusted with their money and are someone they want to do business with. In a nutshell, it’s selling yourself to clients and assuring them of their selection to hire you for their financial planning.

The only problem is that you are unsure about how marketing may benefit you, and it is a valid worry. But not if you use the techniques outlined in this article to help you utilize marketing to your advantage instead of the other way around. You’ll be sure to break past your previous achievements with these “number of” tactics.

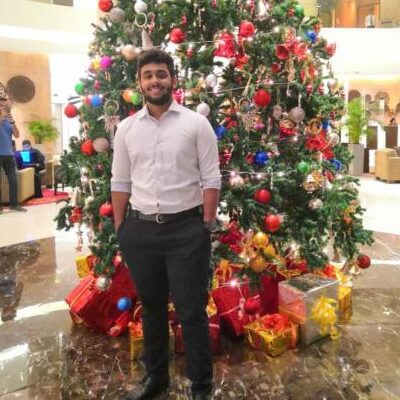

1. Focus on Building Your Brand

One of the most essential aspects of marketing and effective brand management is branding. Branding aids in the communication of what customers and prospects can anticipate from your items and services. It’s up to you to distinguish yourself from the competition because there are hundreds, if not thousands, of additional financial advisors. Brand recognition is one of the first things customers will seek when looking for someone to trust with their finances, so make sure you’re putting time in your marketing efforts.

Invest in a domain name and create a financial advisor website. An ideal financial advisor’s website will be the hub of all online activity, so make sure it is user-friendly, informative, and tells visitors who you are and what you do.

Be active on social media. Platforms like LinkedIn, Twitter or a specifical social media platform for financial advisors called Invespilot, are excellent places to share your brand’s story, connect with potential clients, and publish helpful content. Make it clear why prospective clients should choose you rather than another business. It’s critical for a financial advisor to demonstrate that his or her abilities are genuine. But go one step further and show why YOU are a better fit for them than Fidelity or JP Morgan.

This list of branding statistics should emphasize how crucial it is to brand oneself:

- By consistently presenting a brand across platforms, revenue may be increased by up to 23%.

- Brands that blog generate 67% more leads

- 73% of consumers love a brand because of helpful customer service

- More clients are more inclined to buy from businesses that provide unique information if just over half of the public does so.

It might be tough to establish yourself from the ground up, so use this beginner’s guide to learn how to structure your financial company’s branding.

2. Build Trust Through Authentic Marketing

Customers may be very picky about whom they choose to support. To gain trust and boost customer retention/acquisition, businesses like to use the term “transparency” as a marketing buzzword. However, today’s clients are less trusting, according to research. As a financial counselor, it is your responsibility to educate them and build yourself as a financial professional by engaging with current generations of consumers who are less trusting.

Establish a strong customer-company connection and make sure to educate potential clients on the basics of the sector and how your advice may enhance their financial well-being. It’s critical to demonstrate customers that you value them as individuals while also recognizing that they benefit from a healthy business relationship.

It takes a long time to build trust, but being recognized as a trustworthy advisor pays off. Demonstrate your realness and trustworthiness by doing the following:

- Be Clear and Direct

- Create a Community

- Be Honest and Vulnerable

- Take Responsibility for Mistakes

- Consistently Interact with Your Audience

- Communicate Openly with How You Plan to Fix Issues

3. Invest in Social Media

Social media marketing has become a standard component of any business strategy. Being the ideal platform for introducing new goods/services, organizing events, highlighting charity initiatives, and interacting with fans.

It’s easier to cater to them when it comes to business if you know your audience, but the opposite is also true. The more acquainted you are with your company clients, the simpler it will be to produce social media content that caters specifically to them. This is where generating new material while still catering to existing customers becomes a juggling act.

Knowing your goals is the first step toward using social media effectively. The most important thing to remember is that you should not overthink it; social media isn’t a subject to be stressed about. The goal of social media sites is to provide a platform for interacting with your audience while having fun and sharing knowledge. Begin by asking yourself these questions:

- What should I post to get engagement?

- What is my goal?

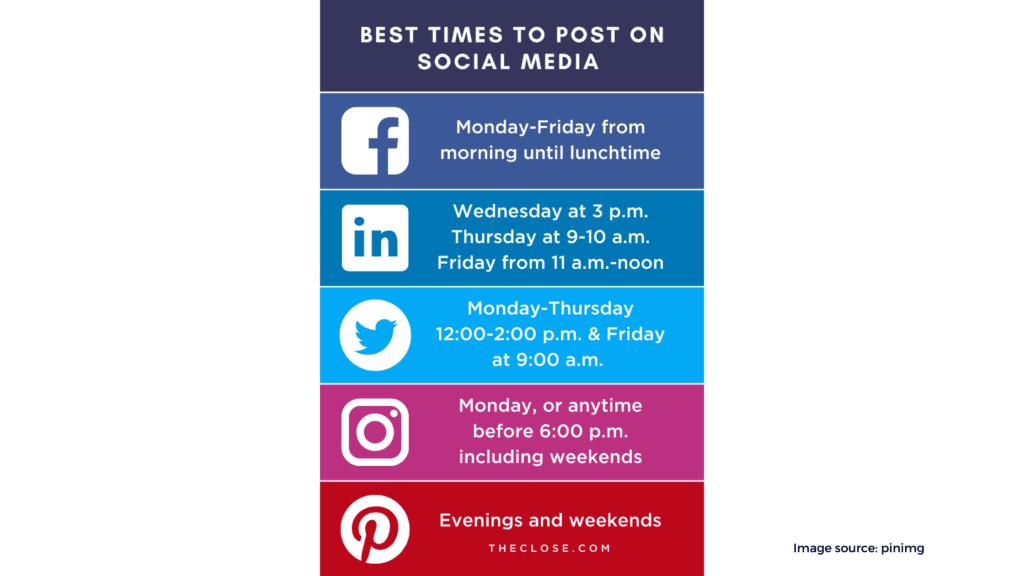

- When should I post?

- What feelings or emotions do I want to convey?

- How do I want my posts to be remembered?

- When visitors visit my post, what type of follow-up action do I want them to take?

The second half of the challenge is to decide to be active on social media. You must now find out what material is useful for both the firm and those who follow you. While it may be tough at first, once you figure out your social media voice, it’s smooth sailing from there. Do you want some additional assistance? Just like financial services companies, there are digital marketing services companies that can assist you to leverage social media.

4. Share Meaningful Content

A solid digital marketing strategy should show your company’s personality and give value to your visitors. This is accomplished through your blog on your website. The aim of the content on your website should be to help clients, starting with educating and addressing typical inquiries in order to establish yourself as a reputable source.

If you want some basic hints on how to produce high-quality material, take a look at this brief video from Samantha Russell, Chief Evangelist for FMG and Twenty over Ten:

We hope you like the content we’ve curated—but if not, feel free to reach out and let us know what you’d like to see more of. FMG’s solution may also assist save some time; check out Twenty Over Ten’s to discover how we can help.

Finally, social media is where you’ll distribute this material, but it’s also when you can show off your business personality. Share your passions outside of the workplace, and embrace your neighborhood, so don’t be afraid to get personal and have some fun.

5. Don’t Fall for Common Social Media Traps

Some social media experts start with just a few clients before quitting because they don’t get adequate response. However, unlike other marketing techniques, social media does not provide an immediate return. Just like the financial services industry, it’s a long-term investment. To realize any benefits, you must stay engaged with your social media followers and keep your account active. And engagement is the key to every successful social networking presence.

To encourage participation, make a practice of commenting on the material of other individuals, even if you’ve never spoken with them before. Tag individuals who you think will engage with your postings and begin a debate. Last but not least, respond to any comments on your writings.

As a result, you improve the likelihood of your own material catching attention. This creates a snowball effect in which other people contribute to your comments, eventually increasing the reach of your posts.

Beyond excitement, you must give value in your content to ensure longevity. This is where the preceding tip comes in handy.

6. Create and Maintain a Marketing Schedule

It’s critical to stay organized. Make a schedule for the days and times you want to publish and share material. You’ll figure out what times are ideal for posting as you continue using social media. This varies from person to person, especially if you use numerous networks. Keep track of timings by keeping tabs, and consider utilizing a calendar to plan your posting schedule.

7. Track Your Success

Many people are making the mistake of tossing away their social media accounts when faced with extreme stress. More and more, businesses are using social media as a tool to reach out to customers. Keeping track of your analytics is critical for determining how effectively your outreach efforts are progressing. Which allows you to determine which postings perform best for your target audience. The big three social media platforms (Facebook, LinkedIn, and Twitter) provide a built-in statistics page that allows you to see how many people have seen or engaged with your postings.

8. Prioritize Email for Communication

The majority of client communications for financial advisors are done through social media, according to YCharts’ Client Communications study. For the most part, advisor clients prefer email marketing as their preferred method of contact. Sending personalized emails about new goods/services, events, and updates allows businesses to stay up to date with their customers. Because it allows for mass messaging, email campaigns are a popular type of email marketing.

What’s important to remember when writing newsletters for email campaigns is to:

- Make sure the content is relevant to your target market

- Don’t just flaunt your services; the objective is to educate new clients.

- Communicate frequently and consistently, especially during times of uncertainty

- Keep in touch during the good times; birthdays, holidays, and just to check-in

- Make sure your content is of adequate length, because the objective is to educate and interact with people, not to read a book.

If you’re having trouble figuring out how to get started with email marketing. Lead Pilot is a tool for financial advisors that provides an all-in-one, easy-to-use platform to significantly increase the number of leads and streamline the whole inbound marketing process.

9. Optimize Your Website for Conversions

It’s unusual to discover a successful firm with no website. Websites have become the foundation of consumer research as Google and other search engines expand. According to a SurveyMonkey poll, 26% of Americans don’t trust financial advisory firms without a website. Trust is the most essential element of client retention as a financial adviser. With a website that explains who you are, what you do, and how you accomplish it, assure your clients that their money is in good hands.

Websites should offer clients with a single location to go for all of their requirements. Whether you’re looking for information, finding services, or just getting in touch with someone, your duty as a financial advisor is to make everything as simple and easy as possible. If you’ve got questions about what it takes to develop a fantastic company website, check out this list:

- Make it easy to find

- Keep your design simple but clean

- Make sure it’s easy to navigate

- Get personal, show off your brand

- Ensure your website runs smoothly and loads fast

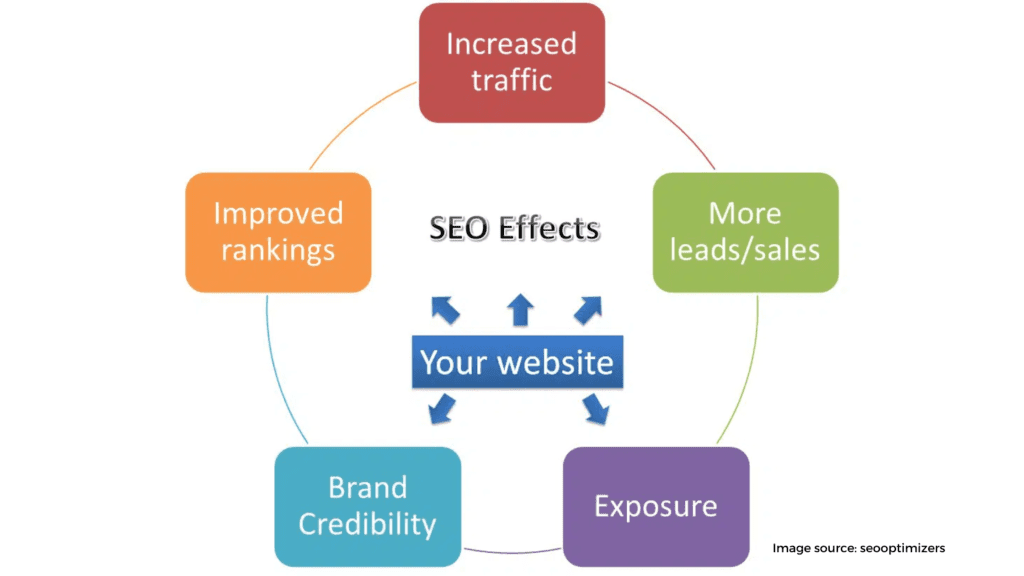

- Incorporating best search engine optimization (SEO) practices

- Have a CTA (Call-to-Action)

Don’t know where to begin? We’re here to help. With Twenty over Ten’s Website Engine, you can make your innovative idea a reality. It was created with customization and ease of use in mind. Website Engine gives you the tools you need to build a website that is tailored to your needs, increases traffic, looks fantastic on all devices, is safe, and links you to all of your favorite applications.

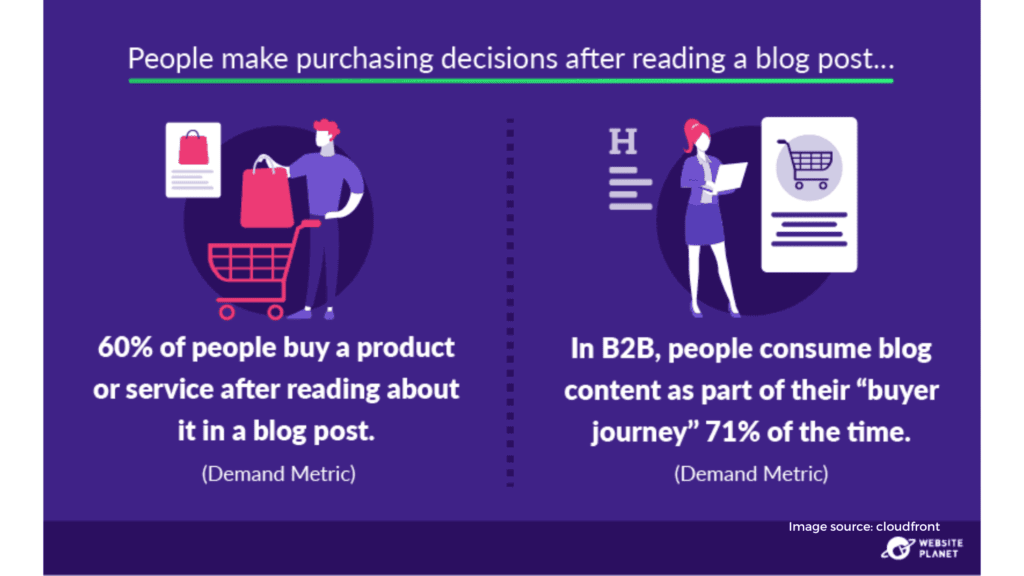

10. Start a Blog

Now that you’ve built a website, the next step is to attract more visitors. Blogging is an excellent method of increasing traffic to your website. Along with giving existing customers something new to read. Information provided through blogs not just keeps your consumers up-to-date, but it also helps build trust and reliability, which makes a financial advisor firm stand out.

When it comes to blog posting, keeping a consistent routine is always beneficial. Set aside one day and hour each week to publish new material, and stick to your plan. When borrowing information or statistics from other sources, be sure to credit them.

IMPROVE CONTENT EXPERIENCE

Everything is now about the content experience. In order to improve the overall experience, it’s crucial to include compelling CTAs, attractive visuals, a well-defined topic, and a distinct value proposition.

DATA-DRIVEN BLOGGING

Statistics are crucial to blogging since they allow you to monitor how well your material is performing. To see your blog’s statistics, use Google Analytics. Keep an eye on the average number of monthly visitors, page views per user session, bounce rate, and conversion rate.

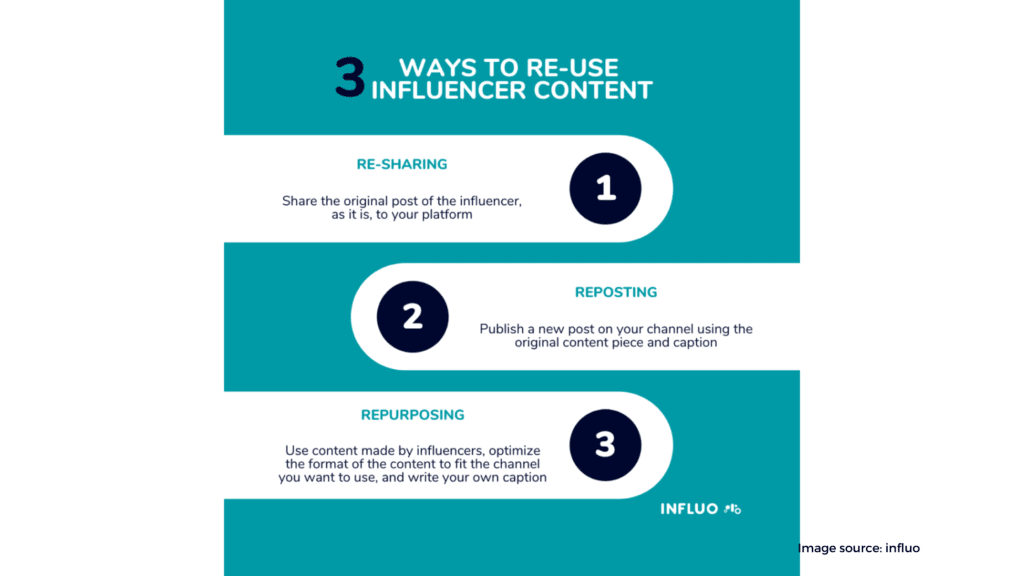

CONTENT THAT IS HIGHLY VISUAL

According to a recent research, people only read 20% of the material on a page. That indicates that capturing a reader’s attention with powerful visuals is important for the success of a blog. Infographics, screenshots, GIFs, and movies are all examples of strong visuals.

Conclusion

Remember to keep these ideas current and expand on them. The more you put into them, the more you get out of it. Consider the methods as fertilizer for your company’s growth. All it takes is a bit of effort and you’ll have a flourishing business that you can be proud of in no time. And if you ever feel like adding some additional fertilizer, we encourage you to return to this article and replenish your supplies.