In the financial services industry, social media has become a crucial marketing tool. Businesses are discovering that platforms like Facebook, Instagram, and TikTok allow them to reach an entirely new audience of potential consumers.

Advisors who wish to expand their brands should consider developing innovative social media strategies that assist raise brand recognition, as well as connecting with industry leaders and influencers.

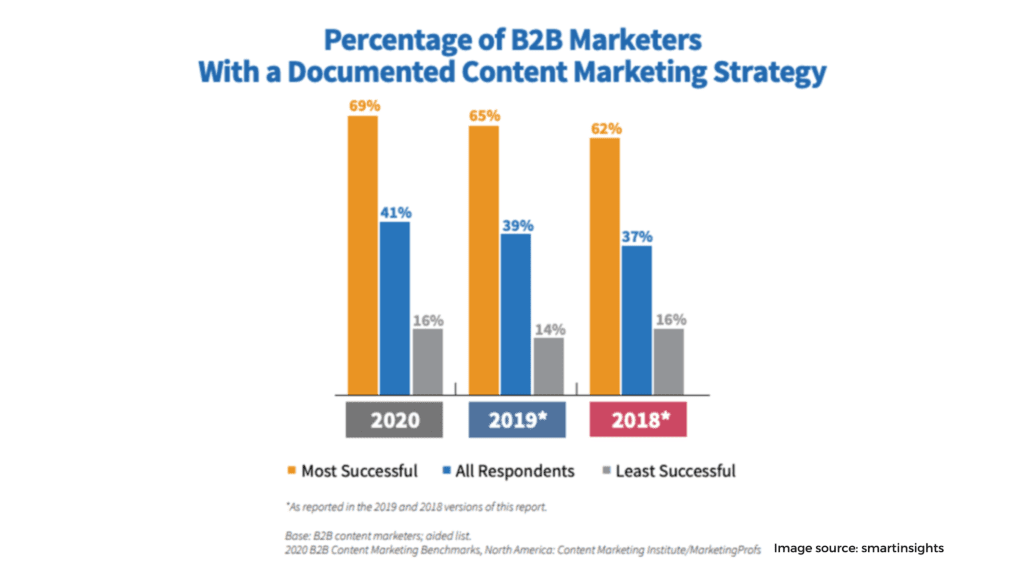

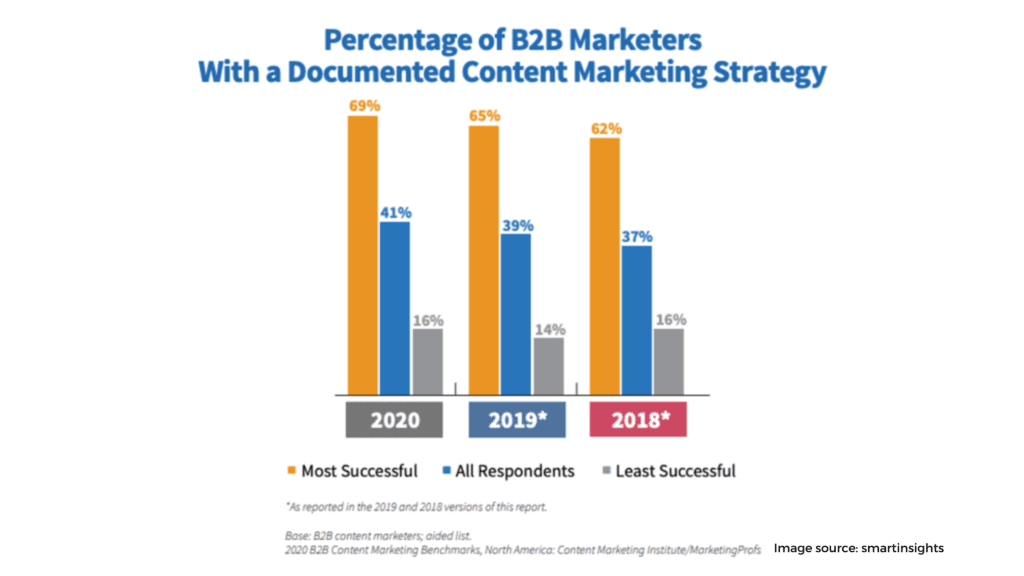

Every financial advisor depends on online marketing strategies to some degree. You need to market your brand in order to attract new clients and grow your business. Traditional marketing methods like print advertisements, television commercials , and radio spots are no longer as effective as they once were. Inbound marketing methods like SEO, content marketing, and social media are now the most popular and effective ways to reach your target market and increase brand loyalty.

1. Share Real-Life Experiences And Client Success Stories

The goal of a financial advisor is to assist their customers. That means increasing your reach and establishing trust by sharing real-life experiences and client success stories on social media. To be effective, the content must be genuine, authentic, and constant.

2. Use Your Own Voice, Not Industry Jargon

Be genuine. Be yourself. Make others feel welcome. On social media, people want to connect with real individuals rather than computers or stuffy businesses. They won’t follow, share, or comment on anything that seems automated. Instead of using business jargon and telling things in complicated language, explain things in easy terms that anybody can comprehend using your own voice.

3. Share Educational Content

Social media is an excellent platform for educating the public. Simply distribute instructional material about the items and services you provide. Make sure to express your thoughts on the article or content. You may use soft-selling techniques by providing thought leadership, appearing as an authority who doesn’t push products down prospects’ throats. Financial professionals can educate their audience with topics about financial planning services like investment management, retirement planning, financial life, financial goals, exchange traded funds, tax planning, personal finances etc.

4. Publish Thought Leadership Pieces

Using social media to promote thought leadership pieces and other content is a smart strategy for financial advisors. Their existing client list may get information in a timely manner, while the advisor gets exposure and brand recognition to aid with marketing efforts. It can also assist the advisor highlight a specific area of expertise, attracting new customers.

5. Post Practical, Applicable Information

A financial institution may and should use social media to distribute informative material about personal as well as corporate finances as part of their digital marketing strategy. Bite-sized nuggets of knowledge that are practical, intelligent, and relevant to your customers and prospects will help you stay top of mind as an authority.

6. Connect Clients With Community Involvement Opportunities

Social media is an amazing tool to help leverage clients and community involvement. As a certified financial planner , you can use hashtags to find non-profit organizations or causes that your clients may want to get involved with. You can also post about community involvement opportunities on your business page and share client stories as part of your viral marketing efforts. Viral marketing refers to the process of creating content that has the potential to be shared over and over again, exponentially increasing your reach.

7. Network And Raise Awareness

Through market research , you can identify potential clients, partners, and collaborators. Social media is a great way to connect with these individuals and get your name as an investment advisor out there. It is a good idea for investment advisors to get in front of potential customers through social media. It offers a convenient method to network and generate awareness. Humans want connection the most out of everything. This establishes a firm foundation, which is reinforced by trust and a relationship that blossoms into an effective business. This generates regular feedback, allowing development to take place.

8. Provide Informative, Bite-Sized Content

Keep it simple and brief. Choose a subject and cover it succinctly. Perhaps you could create a short film, podcast, or article about the topic and provide consumers with an avenue to get in touch with you for more information. No one wants to watch a 15-minute movie or read a novel on social media. Recognize your target audience and be considerate of their time by giving good information.

9. Remind Clients Of Events Or Resources

Our firm utilizes social media to keep our customers up to date on what’s going on with us. This includes reminding people of upcoming events or resources that are accessible to them. We also like to connect emotionally with clients by announcing birthdays, births, and new hires throughout the year when we’re happy about the incredible individuals on our team.

10. Hire A Professional

Treat social media the same as any other marketing channel! You wouldn’t attempt to create an ad on your own, so why try to manage your social media? Unlike conventional networking, the wonderful thing about social media is that you don’t have to do it yourself. I don’t want to put my time into social media as a business owner, therefore I outsource it.

11. Connect Through Shared Passions

Real-time views on industry news and advisors’ passions to connect with prospects and industry peers may be shared through social media. At a high level, strong social media can develop a rapport through business and personnel updates, which might lead to a more meaningful connection with clients and prospects alike.

12. Educate On Topics Not Taught In School

Make sure you cover subjects that aren’t covered in high school or college. This will guarantee that people will not only listen to, but also pass on your material to their followers. Look at what others are doing on social media and do the exact opposite; then do it better. Don’t copy what someone else is doing; make yourself as distinct as possible while still communicating your ideas effectively.

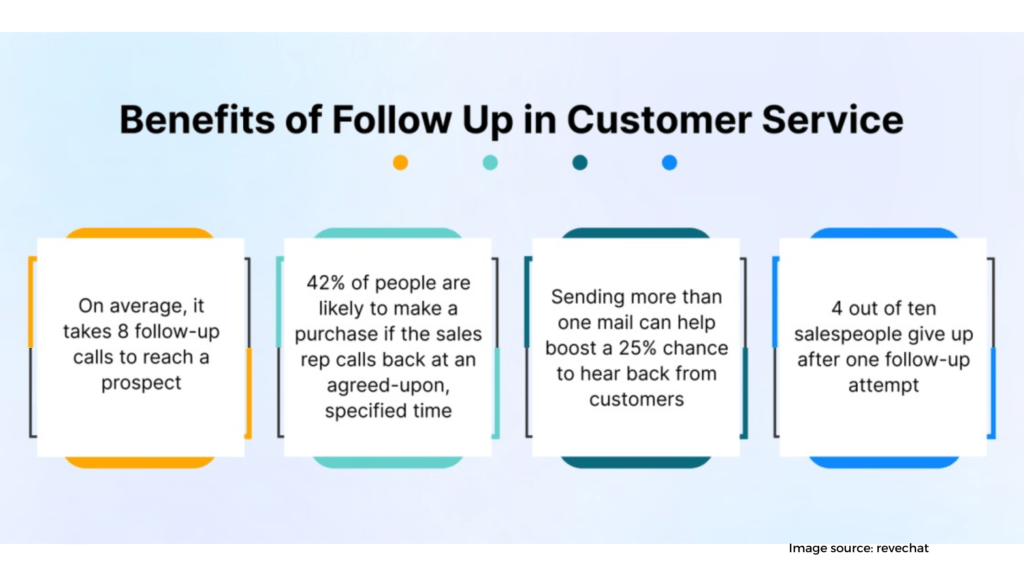

13. Track And Follow Up On Engagement

Advisors should follow the services acquisition playbook of consultants, which advises them to “market thoughts in order to sell services.” Social media is an excellent platform for generating prospects. Advisors that are clever create engaging (and preferably humorous) material and put it on social media. They then monitor and respond to interaction, gathering golden clues that will help them develop one-to-one relationships.

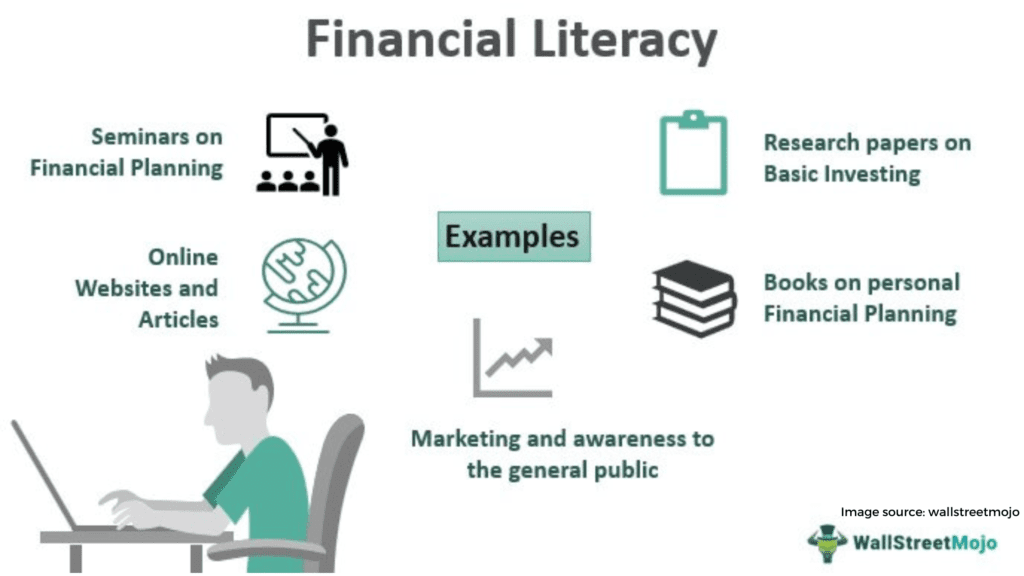

14. Feed Financial Literacy

The idea of trust is the linchpin of any client-advisor connection. Financial advisors should consider themselves educators in order to increase their following and grow their customer base. When financial information and data are given for free, prospects are more likely to follow and even utilize the services of that advisor.

15. Learn More About Your Industry

According to a survey conducted by CastleLane, financial advisors can learn important information on certain social media platforms (such as LinkedIn) and share it with their clients. On social media, there is data on a range of investing alternatives that an advisor may discover. They have the ability to do further study on these investment possibilities, including those from people with different viewpoints, in order to offer client investment suggestions.

16. Get Clients And Prospects Outside Of Their Comfort Zones

Financial planners should not be afraid to get their clients and prospects outside of their comfort zones. They can do this by sharing controversial or interesting articles, as well as blog posts or podcasts that present unique perspectives. This way, people will know that you’re not only knowledgeable about the industry but also unafraid to engage in lively discussion.

17. Seek Professional Help

When it comes to social media, many advisors are still in the dark ages. They don’t understand how important it is or how it can benefit their business. However, by hiring a professional to help them with their social media presence, they can take advantage of all the benefits social media has to offer.

Conclusion

Social media should not be ignored by financial advisors. It is a powerful marketing and networking tool that can help you connect with clients, prospects, and industry peers.

When used correctly, social media can be a powerful tool for financial advisors marketing campaigns. The best financial advisors out there use social media to their advantage, and you should too!