Industry

Insurance

Mortgage Lenders

Real Estate

Financial Planners

Contractors

Auto Repairs

Accountant

Pricing

Enterprise

Get Demo

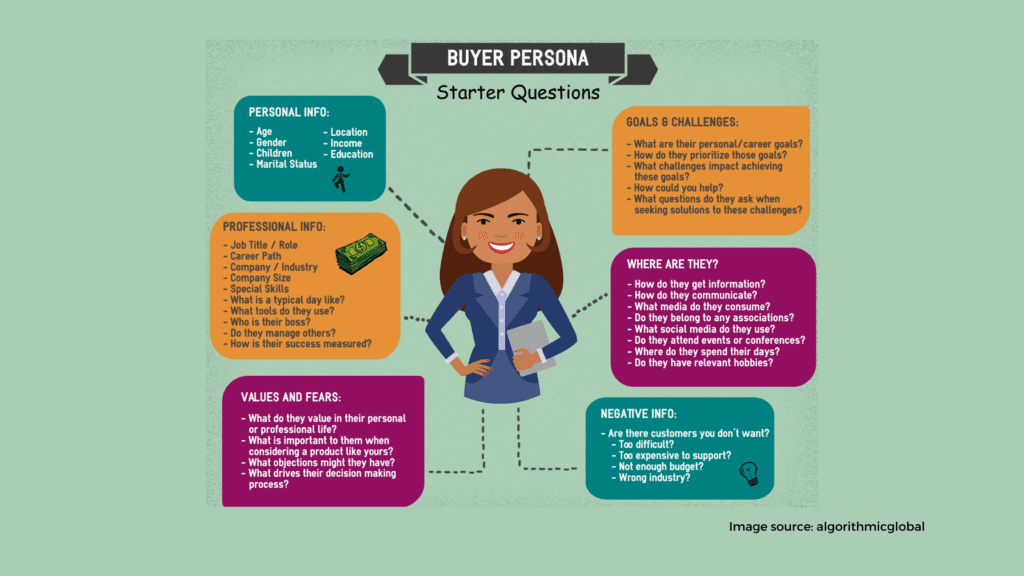

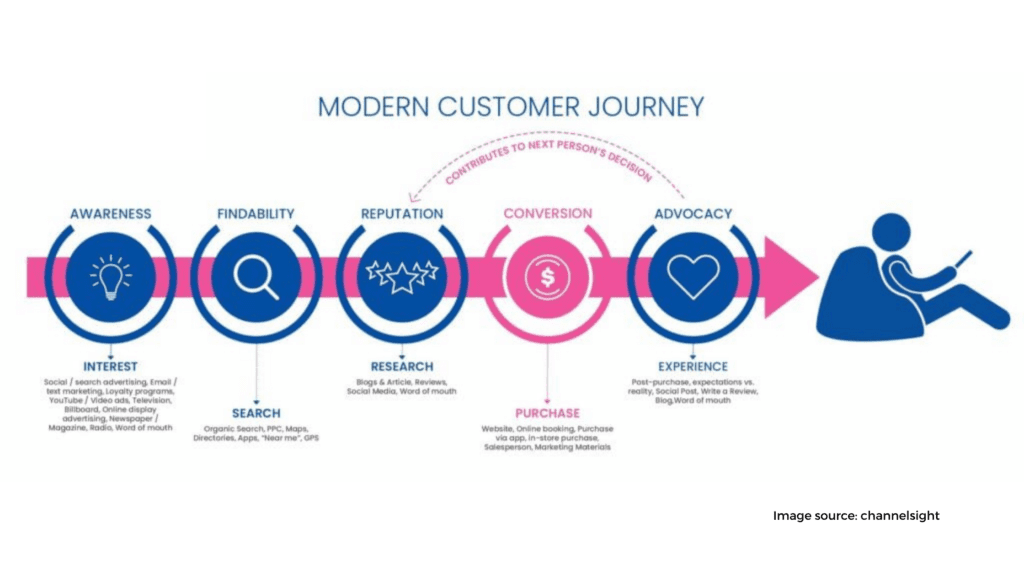

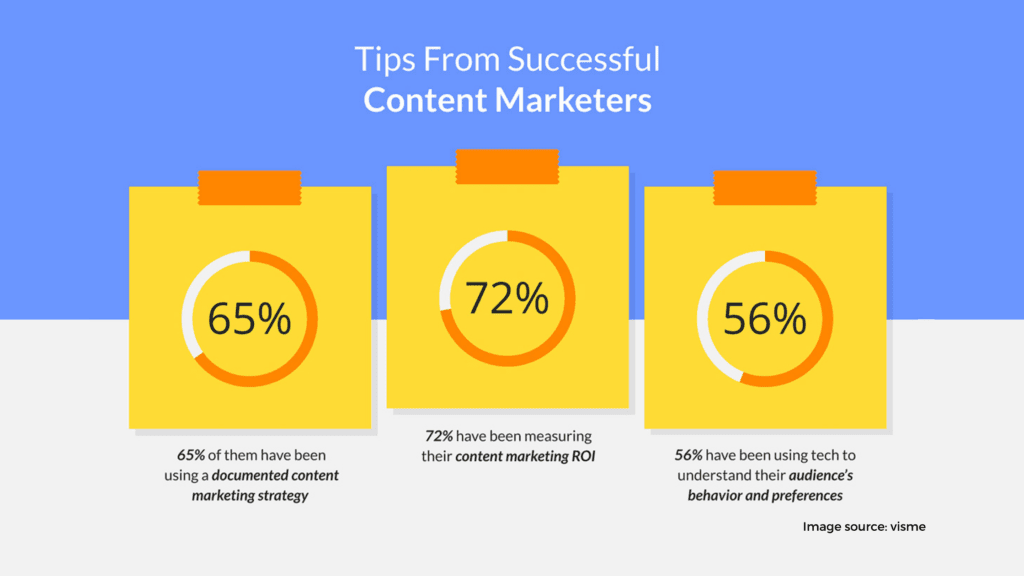

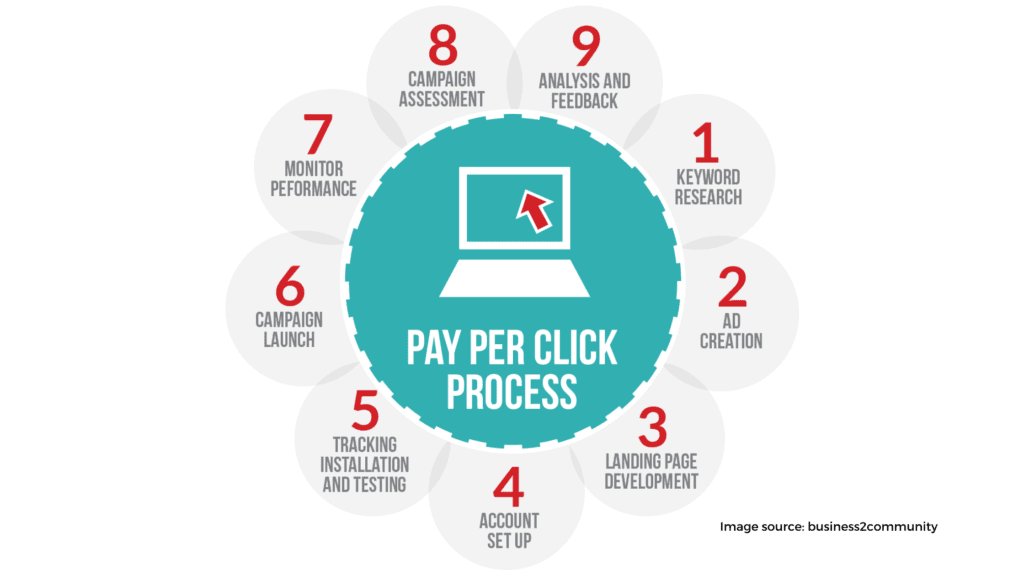

The insurance sector is extremely reliant on growing its client base. You cannot make any sales if your agency does not have anyone to sell your product or service. But how do you find new customers? Insurance companies must compete against the major carriers with larger budgets and local rivals. Almost every single person is a prospect since most people are informed and have some form of insurance — home, auto, renters, or business. It's essential to define and target your ideal client while developing a digital insurance marketing strategy for insurance companies. Baby Boomers are aging, and younger clients are more tech-savvy. This might necessitate adjustments to your plan. Here are 5 top marketing strategies that every insurance agency should be using to grow their brand to stand out in the insurance industry: It's tough to develop a marketing plan until you've identified your target market. Many agencies have an aging customer base, which means many of the marketing techniques they previously utilized to acquire new customers who aren't working anymore. Gen Xers and Millennials are very tech-savvy. Many of them may not understand why you would ever enter a bank, much alone work with an insurance agency in person rather than doing it all online. Make sure you have your ideal customer personas in mind before creating marketing messages that appeal to them. Then, using the appropriate social media and advertising platforms, distribute your marketing material to attract your target consumers. Your website must be highly structured for the consumer journey. This entails quickly leading the consumer to the information they require to make a decision. The most essential data should be readily available. Navigation must be simple and intuitive. Customer comments should be visible. Calls to action should be numerous. Visitors should not have a hard time reaching out to you by email, phone call, letter, or smoke signal. Every individual's preferred means of communication should be catered for on your insurance agency's website. It's critical to establish a connection with an actual person who can provide high-quality customer service. Most folks don't want to communicate with a chatbot or a phone tree. Your website visitors expect your sites to load swiftly and be mobile-friendly. Customers frequently do research before spending on an insurance policy. These lurking visitors may be captured by regularly producing high-quality and unique insurance information on your website. To figure out what information your target customers are seeking when they switch their insurance business, you'll need to conduct data analysis. Explain what it's like to collaborate with your firm. Continually offer rate comparisons for the major insurance providers on your website. Your website should function as a helpful information center where potential customers may go to get all of the information they need to make a selection. As an independent insurance agency, you'll know one of the best ways to make an impact online is to be visible in search engines. Search engine optimization (SEO) is the formula that needs to be included in an insurance agency marketing plan, small or large, to leave their print. SEO is an essential component of every insurance marketing plan. Insurance firms are facing more intense competition than they have in the past. There are a number of SEO techniques you may use to surpass your competition and become the top insurance agency in your market, but it isn't simple. The intricacy of Search Engine Optimization has grown dramatically. It's not something your webmaster can master overnight. It's probably best to get advice from an insurance marketing agency. It's not simply a one-time fix, but the rewards far outweigh the efforts. SEO will improve your Google visibility, resulting in organic traffic and ultimately converting lookers into bookers. It is critical to the success of your whole marketing plan. Insurance agencies are facing fierce competition. Every person wanting to purchase insurance is seeking the greatest bargain, implying that they're probably undertaking a lot of research on Google. Pay-per-click (PPC) advertising is a method for your insurance business to get in front of people who are looking for the best bargain, specific coverage, or simply a local insurance agency. It's not simple to create paid ads for your insurance agency. The days of small business owners being able to simply manage their own Google ads are long gone. Nowadays, even expert analysts get perplexed by the ad platform. There are several alternatives, including geo-targeting, device targeting, bidding strategies, as well as creating attention-grabbing ad text and landing pages. To get the most out of your social media ads, it's best to work with a reputable digital marketing agency. They can use your marketing budget much more effectively than you can. The advantages of partnering with reputable insurance agents can be enormous. Working with an agency that understands your business and location is critical for successful growth. It's a highly competitive business on Google, and establishing oneself requires a well-considered and continuous plan, but the prospect of new client development is worth it. You can't just sit there and wait for your website to fall in Google sea

Define Your Target Audience

Create The Digital Customer Journey

Create High-Quality Content

Devise And Implement An SEO Strategy

Use PPC Advertising

Summary