Finding new business possibilities is one of the most pressing issues for agency representatives. In their early careers, most independent insurance agents recall long hours and lean days while establishing their book of business. As a result, finding new clients might be difficult for even those with prior experience as an independent agent. Most insurance companies offer multiple insurance products in the market, and some only focus on one product.

Whether you’re selling insurance for years or just recently established your insurance company, you’ll need to generate new business to grow revenue and replace clients who have discontinued their coverage. Here are five creative strategies to get new consumers and produce insurance leads:

1. Find your niche

Insurance sales agents frequently want to be all things to all clients, but niche marketing may be more effective to increase your insurance sales. You might benefit from concentrating your marketing efforts on one business category by:

- Create a thorough understanding of an industry’s risks. Occasionally, the hazards are apparent. However, as you gain experience in a given line of work, you become more skilled at assessing risks.

- Gain a competitive advantage. Clients are more inclined to pick an insurance agent who is knowledgeable about their field.

- Raise your reputation. Getting clients the best insurance coverage at a fair price is an effective approach to establish oneself as the industry’s go-to agent.

- Earn Referrals. Referrals are a great way to build your business. As your reputation improves, more clients may be willing to provide new leads for you.

To choose a specialty, begin by looking into the various companies prevalent in your region. It’s also a good idea to join trade organizations, keep up with industry publications, and concentrate your networking efforts on people in the sector.

2. Network in your community

You already know that connecting with new clients is critical. However, attending the same events repeatedly may only end up putting you in front of all of the same individuals. Attend events outside of the insurance industry to meet new clients, such as:

- Trade shows

- Meetup groups

- Local fairs

- Charity events

- Business seminars

- School board meetings

Volunteering may be a rewarding experience in and of itself, but it also has several advantages. You might work with a charity in your region as well. It’s a wonderful way to meet people, but it can also:

- Attract new agents

- Engage employees

- Strengthen your reputation

When someone mentions “insurance,” they’ll think of your company. Connections with the community will make your firm a go-to when someone talks about insurance. In addition, the event will bring your staff together and offer everyone an energy boost.

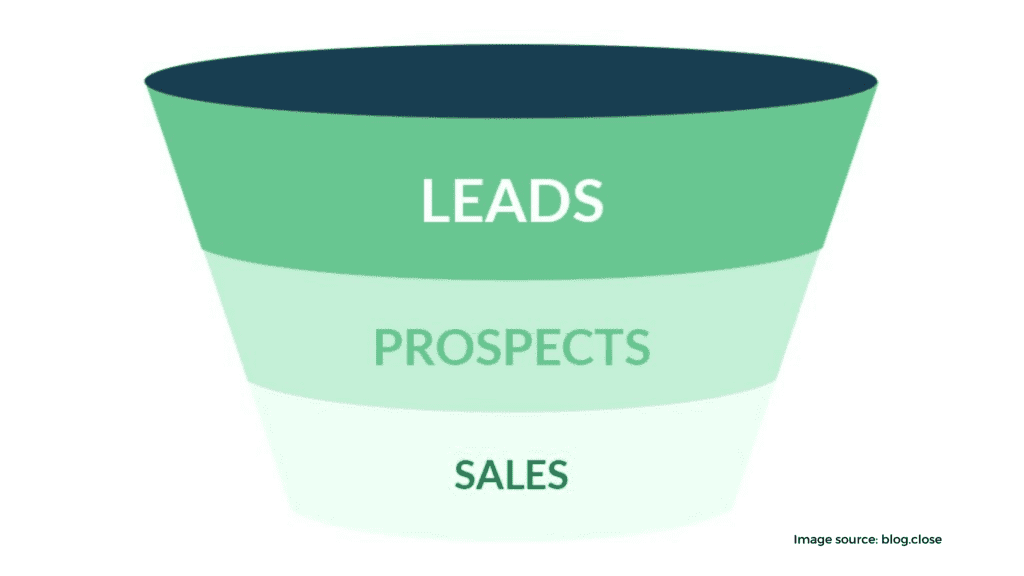

3. Prospect daily

As a new agent in the industry, you probably spent a lot of your time marketing to generate clientele. As your residual income grew, your sense of urgency may have subsided.

Finding new business isn’t something we expect you to do half of your day. However, prospecting is critical for the growth of your firm. Set aside an hour each day for:

- Look up local news sources. Pay attention to the business section, but keep an eye out for engagement updates as well. Both may provide sales possibilities.

- Creating leads. Add features that request email addresses on your website, such as a newsletter subscription form or a “Get a Quote” link.

- Calling business owners. Cold calling has not died; it’s just often unpleasant if not done right. New insurance agents often turn to cold calling, which is not the most productive or effective way to spend your time. Cold calling is a method that has been often taught and used. When you find a contact’s name, look for business listings to research the person’s background. Make sure your call is brief, polite, and personalized.

- Give out some extra business cards. Give new clients and ask your existing clients to share your contact information and phone number with each other to receive.

- Do your own lead generation. Make sure people you know, relatives, and previous customers know the types of insurance coverage and advice you offer.

- Connect with a local real estate agent.

Make sure you pay attention to potential clients and address any concerns or questions they have if you want to increase your return on prospecting. Prepare to describe how insurance may help them save money in the long term by explaining why they require it.

4. Partner with other professionals

Reach out to professionals that may be interested in your current clientele. For instance, you might wish to form a lead-sharing agreement with:

- Mortgage brokers

- Real estate agents

- Accountants

- Financial planners

If you build connections with other specialists in your field, your clients will appreciate the ability to direct them to a specialist who can help. It’s also a win-win for both professionals when the other professional delivers new consumers and possible clients to your company.

5. Nurture your leads

Although it would be wonderful if every pitch resulted in a sale, the insurance sector seldom works that way. That’s why growing leads is as essential as nurturing them. As a result, you may want to set up a system that keeps your company top-of-mind while also demonstrating the value you offer. To do so, consider the following:

- Create blogs integrated with search engine optimization (SEO) that showcase your knowledge in life insurance, annuities, health insurance, and other insurance needs. Create short educational videos explaining different policies.

- Create webinars on how insurance can address the client’s worries.

- Send personalized emails with useful risk management ideas regularly.

- Connect with your insurance clients on social media platforms like LinkedIn and provide useful information to grow your customer base and increase public awareness of your firm.

Don’t underestimate the power of email marketing. Sales should soon follow if you send out a newsletter filled with helpful tips and advice. That’s the key to building a successful insurance agency: become a friendly, well-known expert, and new business will come to you.

It is one of your top priorities to generate clients for your insurance firm and assist them in obtaining coverage. Still, it is also critical to get the appropriate insurance coverage for your own business.