Insurance and social media. It’s not something that rolls off the tongue in the same way as social media for retailers. Still, with a little creativity outside of the box, your insurance business may become king (or queen) of social media and reap the benefits that these platforms provide. There’s no disputing that social media is a difficult platform, especially for highly regulated sectors. But there are several reasons why your insurance firm should be blogging, Instagramming, and updating its status to increase the number of leads that come through to your website. This post will explain how you, as an insurance firm, can improve your company’s ROI by making use of social media. Here are the top five reasons:

It helps build brand awareness

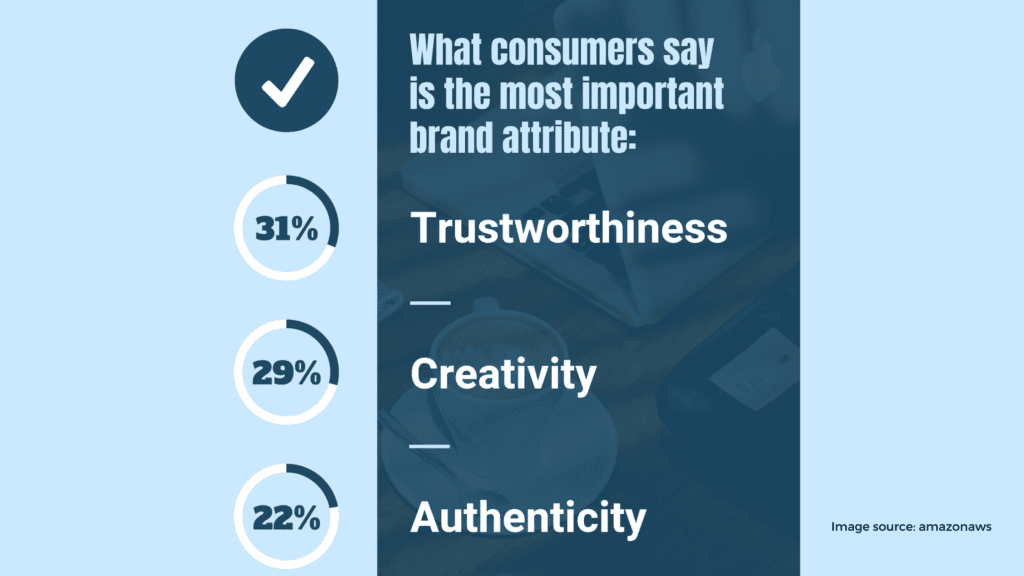

One of the main goals of any insurance company should be to increase its brand awareness. After all, if more people know about your company, they’re more likely to do business with you.

Fortunately, social media is a great way to achieve this goal. A study by the Harvard Business Review showed that 92 percent of consumers who follow a brand on social media are more likely to buy from that company.

What’s more, social media platforms are the perfect place to show off your company’s personality. You can make your company more relatable to potential and current customers by posting funny or interesting content. You can also use social media to share news about your company and its products.

It can elevate your customer service

The advantage of utilizing social media in the insurance sector is that you may distribute new coverage and links to useful industry information and interact directly with your present and potential customers. It also implies that if clients have issues, want to know more, or just need help. You can respond promptly using your Facebook or Twitter accounts and demonstrate to new prospects that you care about your customers. According to research by Convince & Convert, 42 percent of customers expect customer service to reply within one hour, and 32 percent desire a response within 30 minutes. If you don’t maintain the same response rate as your target market prefers, you’ll fall behind because your competitors provide faster and more efficient services.

With social media insurance evolving rapidly, more and more methods to communicate and react to your customers are emerging. For example, Twitter introduced a “prompt DM” function several years ago that adds a call to action at the bottom of your message, urging consumers to immediately contact your firm for further information. This allows you to respond promptly to difficulties and earn that sought-after excellent customer service reputation!

It enables creative digital content

If you’re like most insurance companies, you plaster your website with dry, boring facts and figures about your policies. Unfortunately, however, this type of content is often ignored by readers who would rather learn about the coverages they’re buying without having to scroll through a bunch of legal jargon. What’s more, if potential customers do take the time to read your website’s content, they may be turned off by how unappealing and dull it is.

This is where social media can come to your rescue! Whatever service you provide to your consumers, insurance companies on social media should think outside the box when it comes to their posts. You’ll also want to ensure that the ad copy you use resonates with your target audience. Finally, the creative material you’ve produced will leave an impression on your current and potential customers, as well as connect with your target audience, maintaining their attention even after they’ve clicked away.

By utilizing platforms like Instagram, you can post creative and visually appealing images that intrigue your audience. Since Instagram is a photo-sharing site, people are more likely to stop and look at your posts, leading to more website visits. As a bonus, you can also use videos on YouTube to create short and informative product demonstrations that will help people understand what coverage they need.

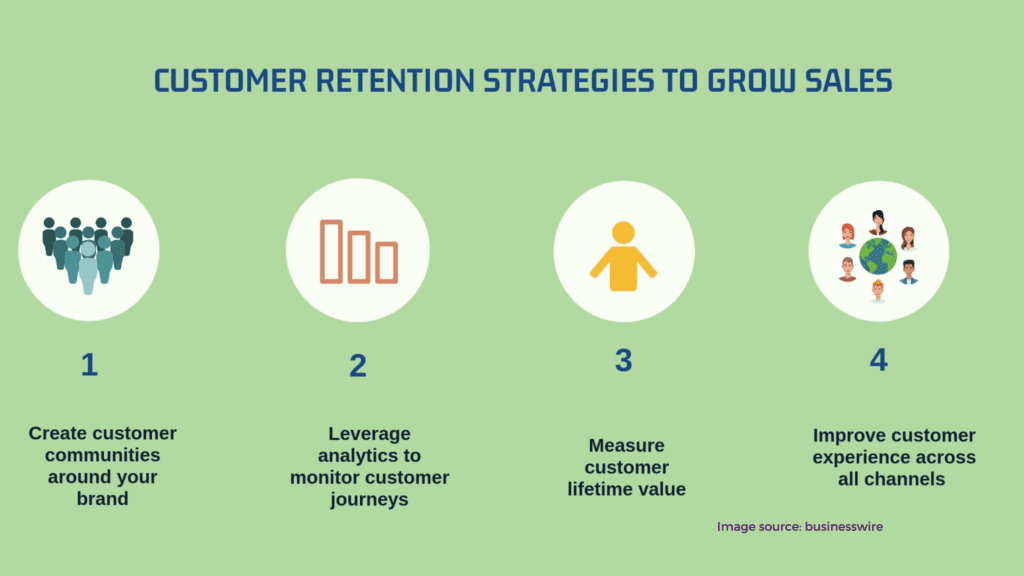

It can help with customer retention

Customer retention is an important goal for any business, and the insurance industry is no exception. A recent study by Bain showed that increasing customer retention rates by 5 percent could increase profits by 25 to 95 percent.

One of the most effective ways to retain customers is by keeping them informed about what’s going on with their policies, and social media is a great way to do this. In addition, social media can also help you learn about what customers want and need from their insurance policies. For example, if you offer a discount for customers who purchase multiple policies or have been with the company for a long time, you can use social media to announce this to your customers.

In addition, you can use social media to reward your customers for their loyalty. This could be in the form of a contest where the winner gets a free policy renewal or a gift card. Whatever the reward, it will make your customers feel appreciated and valued, which is sure to encourage them to stick with your company.

It can help with SEO

Most people know that having a strong SEO strategy is important for any business, and insurance companies are no exception. However, many firms make the mistake of thinking that stuffing their website with keywords is the only way to achieve better rankings in SERPS. While this tactic may work for some firms, it’s not as effective as it used to be.

This is where social media comes into play! By creating compelling and shareable content, you can improve your website’s SEO ranking without resorting to spammy tactics. A study by Searchmetrics showed that the number of social signals (likes, shares, and tweets) a website has is one of the most important factors for ranking in Google’s search engine.

Since social media is a powerful tool for creating and sharing content, it can help you improve your website’s SEO significantly. Not only will this result in more website visitors, but it will also help you attract new customers who are looking for an insurance company that can meet their specific needs.

Conclusion

Social media is an important tool for any insurance company that wants to stay ahead of the curve. By using creative and engaging content, you can reach more people and connect with your target audience in a meaningful way. In addition, social media can help you improve your website’s SEO ranking, which will result in more website visitors and potential customers. Finally, social media can help you retain existing customers by keeping them informed about what’s going on with their policies. So, if you’re not already using social media, it’s time to start!