Is your financial planning services company leveraging social media effectively? If you aren’t, your rivals are stealing business from you.

The sector is changing rapidly in financial services, from the growth of cryptocurrency to the development of fintech apps to the creation of robo-advisors. As the financial services industry becomes increasingly digital, social media marketing is becoming more essential as a tool for promotion.

Even if your financial institution is more traditional, social media is an important way to reach younger customers. And you need to be ready for what’s next. By 2026, 75% of financial services executives predict big changes in the sector, according to Gartner.

Here’s why (and how) to build a financial services social media strategy this year.

8 reasons to use social media in financial services

1. Reach new audiences

Gen Z is looking for financial knowledge on social media. This year, the oldest members of this group will be 25 years old. And they’re reaching important milestones that need financial guidance. 70% of them already save for retirement.

Every month, around a quarter of 16-to-24-year-olds visit a financial services website or app. A cryptocurrency is owned by 10% of this age group.

Social media is a vital channel for connecting with potential consumers, whether you’re marketing to Generation Z or not. More than three-quarters (75.4 percent) of internet users use social media for brand market research. In order to gain brand loyalty, you must be where your target clients are spending their time–and that’s on social media. Showcase your products and services through inbound marketing techniques to convince people to choose you to chase their financial goals.

2. Strengthen relationships

For financial sector employees, building connections is one of the most important uses of social media. When it comes to money, everyone wants to deal with someone they know and can trust.

As a certified financial planner, showcase the range of services you provide such as investment management, exchange traded funds, business strategy, retirement planning that will benefit financial life.

Social selling is the practice of nurturing clients and prospects online. Here’s a quick rundown on how it works:

The use of social media can assist marketers in recognizing crucial financial events in their clients’ and prospects’ lives. LinkedIn is an excellent source for job changes or retirement announcements, for example. Following your client’s company pages may also provide you with valuable information on their problems.

Nonetheless, most social selling is about establishing connections. Sales are a more long-term objective.

Send a congratulations message when a connection gets a new job or opens a new business. (Nearly 95 percent of social media experts use some type of direct communication.)

Keep yourself in people’s thoughts. However, don’t go leaping in and attempting to sell anything. On social media, nearly a quarter of Internet users follow a company they’re thinking of buying from. They want to observe and follow for a while before making a decision.

Focus on the client’s requirements rather than making a sale.

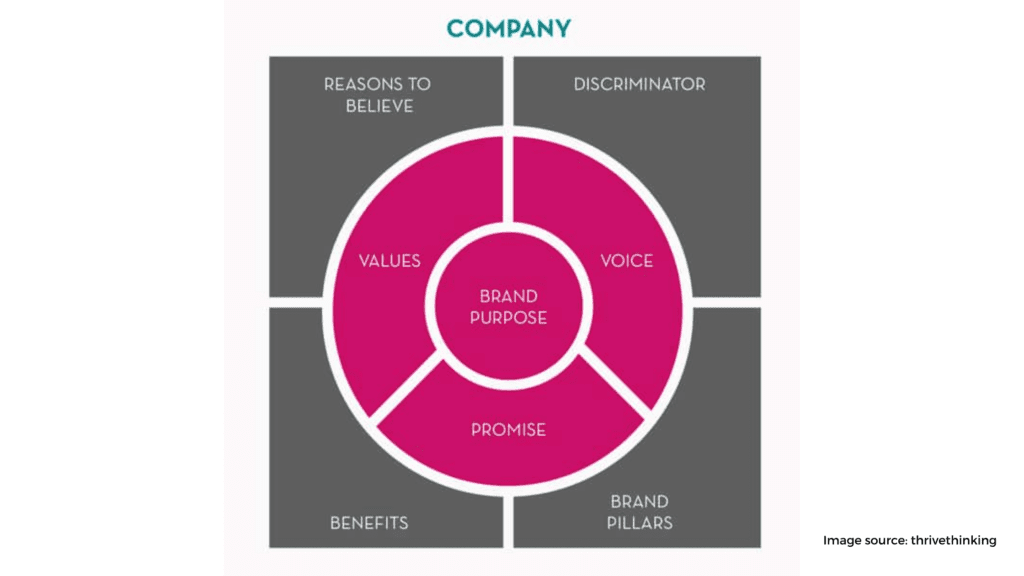

3. Highlight brand purpose and build community trust

Financial services firms must now demonstrate that they are more than simply profit-driven.

According to a poll by Edelman Trust Barometer, 64% of respondents invest based on beliefs and values. And 88 percent of institutional investors “subject ESG issues to the same level of analysis as operational and financial factors.”

Younger investors are particularly drawn to sustainable investing. According to a CNBC Harris Poll, a third of millennials, 19% of Gen Z, and 16% of Generation X “often or exclusively” utilize ESG-focused investments.

The findings were the same in North America and Europe, where three-quarters of millennial investors said that they believe it is part of their investing duty to help resolve social issues.

Over the last decade, trust in the financial services industry has improved. However, it is still the least trusted industry, according to the Edelman Trust Barometer. You may establish trust and address client concerns by using social media.

4. Humanize your brand

Customers are looking for reputable financial advisors. That does not imply that they want their financial services providers to be clinical and clinical. Using social media, you have the ability to humanize your brand.

Getting your company’s executives onto social media might be a good place to start. After all, it’s easier to trust someone than an institution.

Potential clients want to see your C-suite executives on social media. Business leaders should use social media, according to 86 percent of financial magazine readers. They trust CEOs who utilize social media by a factor of 6 to 1 over those who do not.

Of course, the tone you use will be determined by the network you’re using and the target audience you’re trying to appeal to.

The average advisor uses 4 social networks, with the most successful using 6. From LinkedIn to Facebook, financial professionals are also inceasingly using Instagram and TikTok.

5. Gain key industry and customer insights

Use social media for financial services industry research. This is a fantastic method to stay on top of what’s going on in your business area.

Viral marketing refers to the use of social media to spread awareness about a product or service. A study from Boston Consulting Group (BCG) found that companies that focus on viral marketing are 5.7 times more likely to experience rapid growth. As a financial advisor ,you can use social media to go viral.

Is there a new product from a competitor? Is there an impending PR disaster on the horizon? Consider social media as an early indication of trouble.

Social media monitoring can tell you what’s going on in the world. Here’s how it works:

You may also utilize social listening to figure out what your potential consumers want from you and how they use your product or service.

Also, keep an eye on your social media analytics. These technologies give you information about the effectiveness of your own social efforts. You can figure out what works best for you. Then, as you refine your financial service customer social media marketing plan along the way, adapt it to suit them.

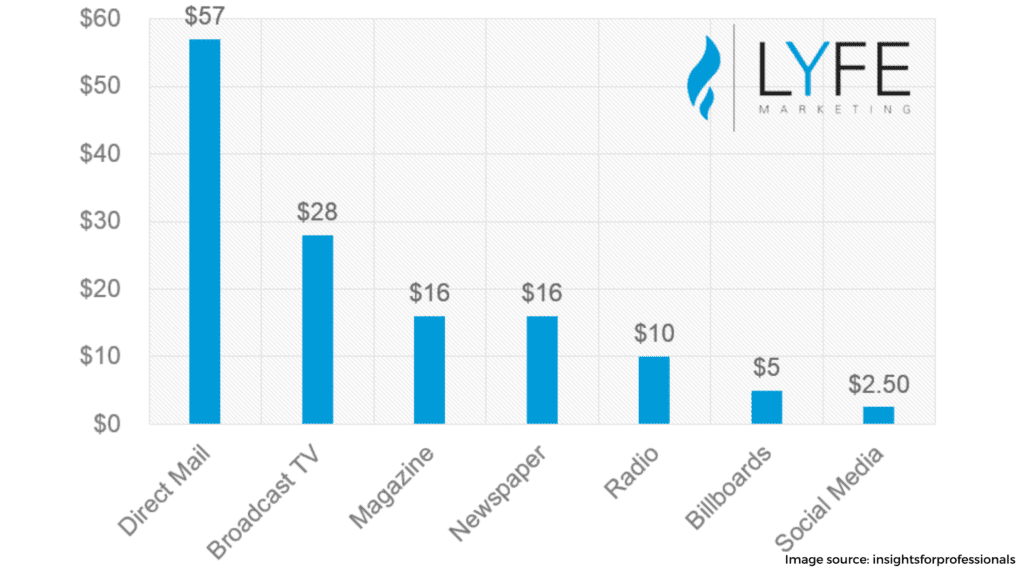

6. Reduce effort and costs

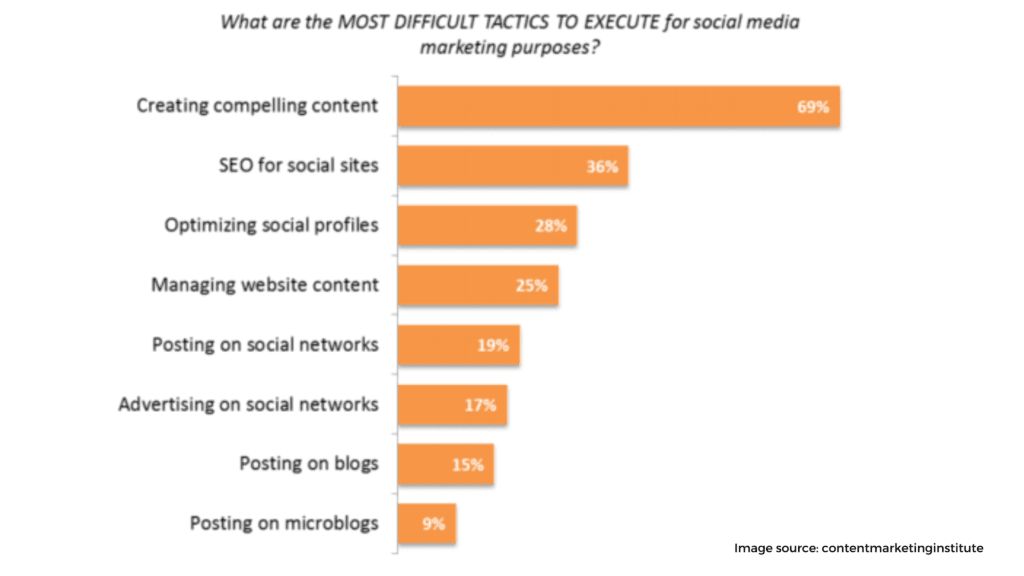

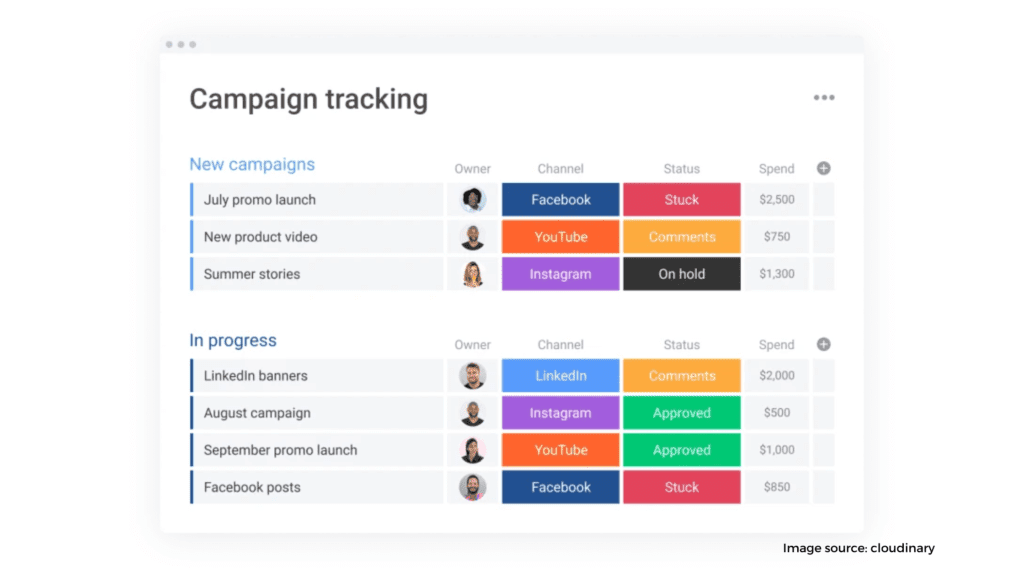

Most social efforts are most effective when departments, teams, and individual advisors collaborate to use social media. This is almost certainly the case with a shared social media management platform.

A content library is both a useful tool for staff and a profitable business asset. Employees have access to pre-approved, compliant material that is ready to go. When employees express consistent messaging that supports corporate objectives, marketers enjoy peace of mind.

Everything is housed in one main library, so there’s no extra work or money spent. The top two fears of financial advisors regarding utilizing social media are addressed through this pre-approved library:

- Fear of making a mistake

- Lack of time

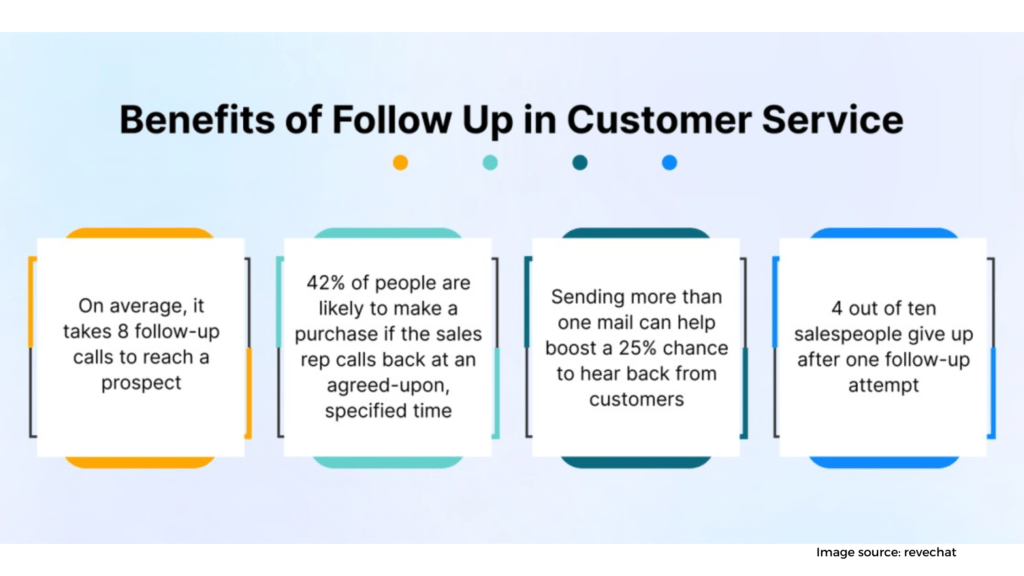

7. Provide unified digital customer service

As the financial industry becomes increasingly digital, customer service needs to follow suit. Your digital marketing strategy should make it convenient for customers wanting to reach out to businesses on the platforms where they already spend their time. That might imply social networking sites like Facebook or social messaging apps such as WhatsApp.

A social customer care platform allows you to handle customer service across all channels. At the same time, you may connect conversations to your CRM. This helps guarantee that you fulfill response-time standards and keep track of things.

You may also use social media bots to handle simple customer service inquiries or send visitors to existing content on your website. Bots can also be used to filter incoming requests, matching customers with the appropriate members of your customer care staff.

8. See real business results

Simply said, social media has an impact on your bottom line in a tangible way.

According to a recent study, almost three-quarters of financial advisors (74%) have gained new business assets through their social media efforts. Advisors that use social media effectively report an average of $1.9 million in assets acquired as a result of social media interactions.

According to the findings of Deloitte’s 2018 Global 2022 Gen Z and Millennial Survey, young people’s confidence in their personal financial situations is increasing. While both of these generations are still concerned about their financial stability, they are nevertheless pessimistic.

At the same time, the Natixis Global Survey of Individual Investors found that 40% of millennials—and 46% of high-net-worth millennials—aim to get personal financial guidance from a professional. Connecting with these potential customers on social media is a fantastic method to reach out to them.

Building a social media strategy for financial services: 4 tips

1. Focus on compliance

The multitude of regulatory bodies and frameworks—including FINRA, FCA, FFIEC, IIROC, SEC, PCI, AMF, GDPR—can make your head spin.

It’s crucial to have compliance procedures and technologies in place, particularly for independent advisors who use social media.

As you build your financial services social media plan, get the attention of your compliance staff. They’ll have important pointers on how to keep your brand safe.

It’s critical to have the appropriate chain of approvals in place for all social media postings. FINRA, for example, advises:

“Before using any social media site, a registered principal must check it out.”

2. Archive everything

Compliance is a broad term that encompasses many aspects of your company’s operations. This, too, is part of compliance, but it’s significant enough to merit its own mention.

According to FINRA, “Firms and their registered representatives must keep records of all communications related to their ‘commercial operations.’” Those records must be kept for at least three years.

3. Conduct a social media audit

In a social media audit, you keep track of all of your company’s social media platforms in one location. You also include any relevant information for each. At the same time, you’ll look for impostor or unauthorized accounts to have them deleted.

Begin by making a list of the accounts your internal staff utilize on a regular basis. But keep in mind that this is just a starting point. You’ll need to search for obsolete or abandoned accounts, as well as department-specific ones.

Make a list of all the social networks where you don’t have any social accounts, while you’re at it. It’s possible that it’s time to create profiles there. (Anyone using TikTok?) Even if you aren’t ready to use those tools yet, you may wish to reserve your brand handles for future usage.

We developed a free social media audit template to assist you in keeping all of your research organized as you go through this project.

4. Implement a social media policy

A social media policy governs the use of social media within your company. This covers, among other things, your advisors and agents’ accounts.

All of these individuals and teams should be contacted, including but not limited to:

- Compliance

- IT

- Legal

- Information security

- Public relations

- Human resources

- Marketing

All these teams should have input. This will help you maintain a consistent brand identity while reducing compliance challenges.

Your policy will also describe team roles and approval procedures so everyone is on the same page when it comes to posting on social media. This clarity from the start might help to avoid people getting angry if things don’t happen as quickly as they’d like on social media.

Even in the finance industry, using social media for commercial purposes can have security concerns. Include a section in your social media policy that details security standards for less-sexy aspects of social networking. For example, set guidelines on how often passwords should be changed and whether software should be upgraded on a regular basis.

Conclusion

When it comes to social media, the finance industry has unique concerns when it comes to investment advisors. However, by being clear about these concerns from the start and setting standards for security and privacy, financial companies can use social media to reach new audiences and connect with customers on a human level.

There are many successful examples of financial companies using social media campaigns to engage with customers , increase brand recognition, and build trust. With the right approach, any financial company can create a social media campaign that will achieve its goals.