Shaking up your marketing strategy is one way to boost your financial institution. There are several ways to attract new consumers, from social media to digital marketing and outbound content. Inbound marketing should also be a top priority as it’s an excellent way to target new customers who are already interested in the financial services that you have to offer. We’ve compiled a list of 13 of the most effective marketing techniques for you.

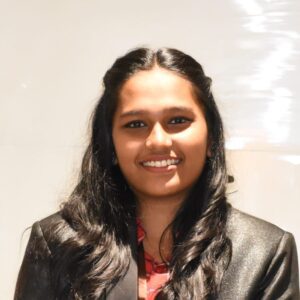

1. Embrace digital marketing

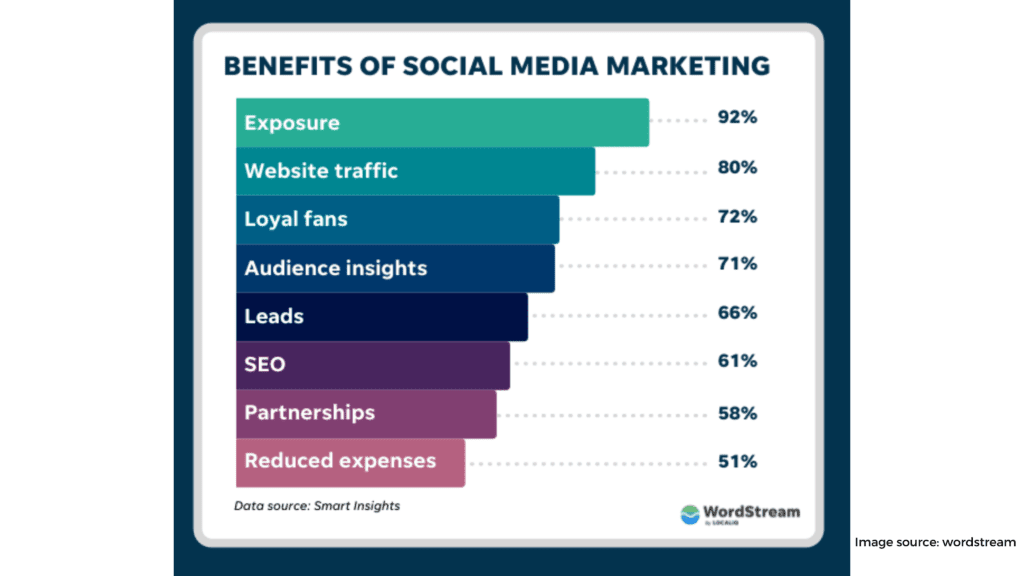

When compared to traditional marketing and advertising techniques like pamphlets, billboards, and media advertisements that need a big investment and/or a lot of manual work, a digital marketing strategy is a lot more efficient, trackable, and cost-effective. You can use various digital channels like email, social media, search engine optimization (SEO), and content marketing to reach out to your target audience.

You can use free online marketing platforms to spread the word about your brand and tap into an unlimited pool of potential customers who are curious about the topic you know best. When you consider that the typical person spends two hours and 24 minutes on social media every day, you’ve got a captive audience if you know how to engage them. Of course, that’s the difficult task — and the only way to learn is to trial and error until you figure out what works best for you. If you’re able to project a positive attitude across social media, this may be your chance to monetize that skill.

2. Outline your strategy

It’s like going on a journey without a clear goal when you get started marketing activities without laying down the groundwork. You’re less likely to succeed, and if you do (by chance) you may not be able to discern exactly what it was that helped. Before you start anything, sit down and figure out what it will take:

- How much time do you have to devote each week to marketing?

- What is the most important objective of your marketing (such as increasing conversion, raising brand awareness, or establishing yourself as a local expert)

- What you’ll do if you don’t have specialized skills (e.g. how will you construct your blog if you’re not a confident writer)What strategies are available to you?

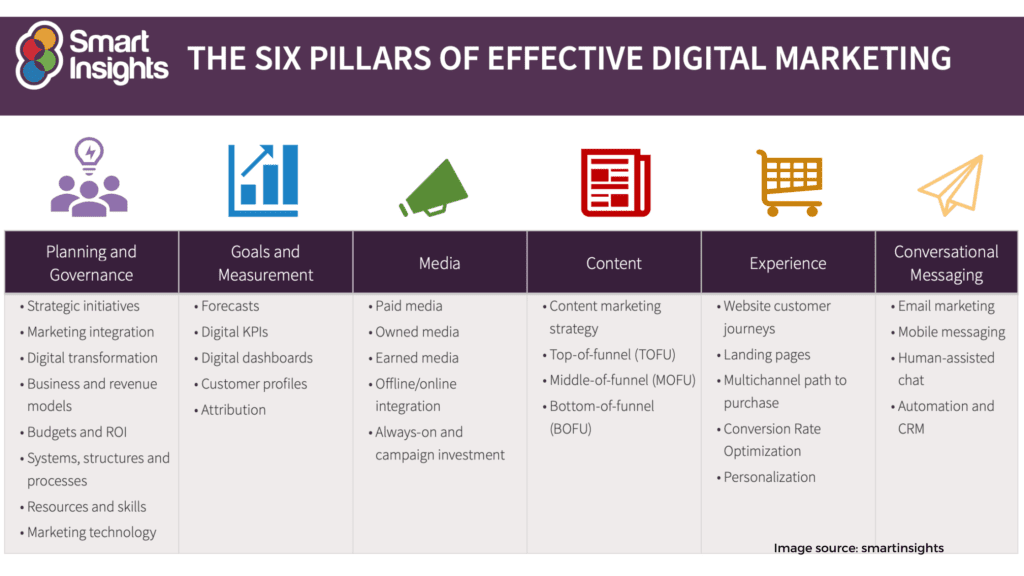

3. Understand your niche

Working out where you sit in the market and how you can differentiate yourself from other financial planning services will help you tailor your marketing efforts. For example, if you deal with a lot of high-net-worth clients, you may customize your communications to issues that are most likely to concern them. Clients with modest incomes, on the other hand, will face various significant issues. These are just a few of the obvious examples; however, you may apply the same principles when studying in greater depth. If you specialize in long-term care funding, for example, think carefully about the demographic most likely to search for you – not the individuals receiving care themselves, but their children (who may be in their 40s, 50s or 60s).

Build a mental picture of your ideal customer(s) and begin personalizing all of your marketing communications as though you were speaking with them, in their native language.

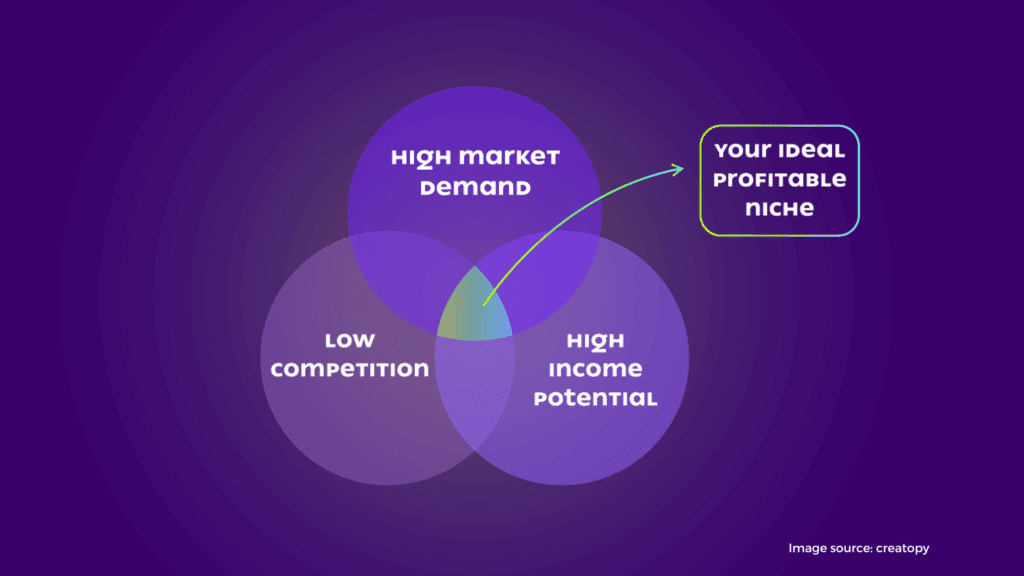

4. Improve your website

If your website is hard to navigate, out of date, not optimized for mobile users and doesn’t answer key customer questions, your efforts may be in vain. One experiment found that even a single spelling mistake can reduce sales by 50%, so it’s something to take seriously.

A poor website can hamper your conversion rate (how many of your leads become paying customers), so it’s vital you improve it as soon as you can. If you’re not confident with web design investing in professional help will definitely pay off, as you’ll feel confident your website is attractive and fit for purpose.

Before you devote a lot of time and money into your new website, make sure you’re ready for an increase in new inquiries and customers.

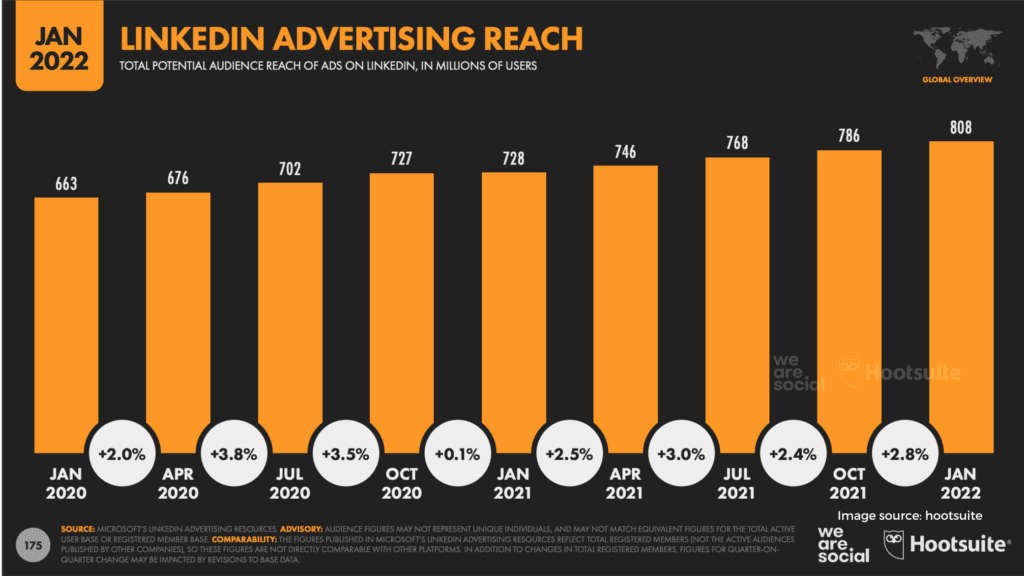

5. Utilize networking sites like LinkedIn

Building quality connections with like-minded company experts is a tried and true method to boost your new prospects. It’s especially vital if financial professionals frequently deal with commercial clients, since you may connect with them and start up an informal conversation, which has the potential to lead to new business.

You can also become part of the financial community by making contacts with other IFAs all around the world, which might lead to additional business. Let’s assume you’re based in Edinburgh but have a good connection with a London-based advisor. If one of their regular clients or another person in the community who has heard great things about them expresses an interest in working with you, you’ll be at the top of their list.

6. Build a strong social media presence

Despite the fact that it has several drawbacks, Facebook might be an extremely useful marketing tool. It and other social media sites can assist you in contacting a wide range of new leads if used appropriately. Different age groups prefer various websites, so it’s worth doing your market research to figure out how to appeal to your desired demographic.

Regardless of the channel you choose as a financial advisor, make certain that you post material on a regular basis to ensure your brand is visible in their feeds. Always aim for quality rather than quantity when posting anything of worth that can inform, inspire, amuse, or persuade others. The most essential aspect of public relations is to be seen; you can’t achieve this if you’re not active on social media. The best financial advisors include showcasing quality services in their business strategy. Services like investment portfolio management, financial goals planning, exchange traded funds, personal finances, tax planning etc. Viral marketing refers to techniques that try to take advantage of social networks to achieve marketing goals. It is sometimes seen as a form of online word-of-mouth marketing.

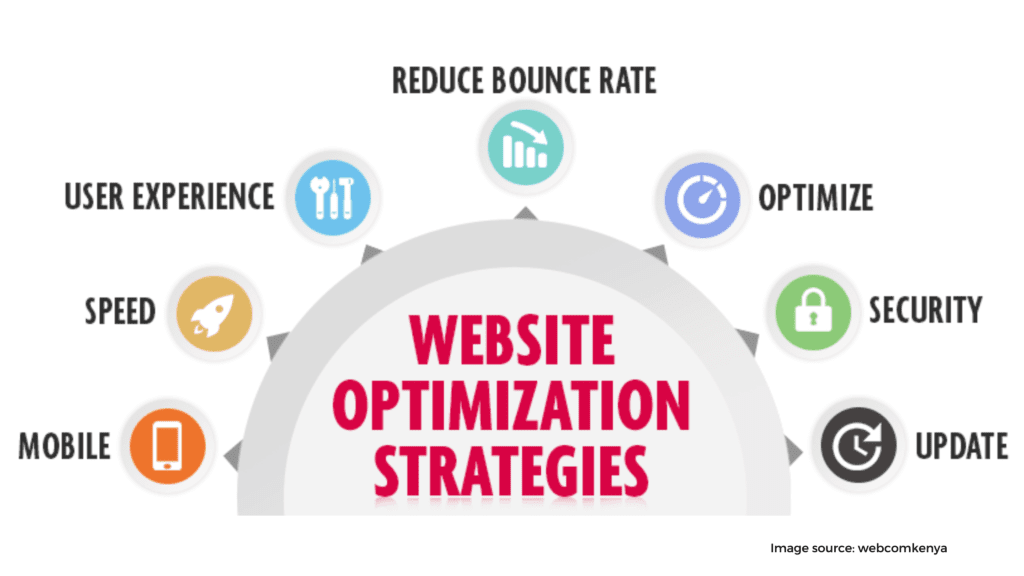

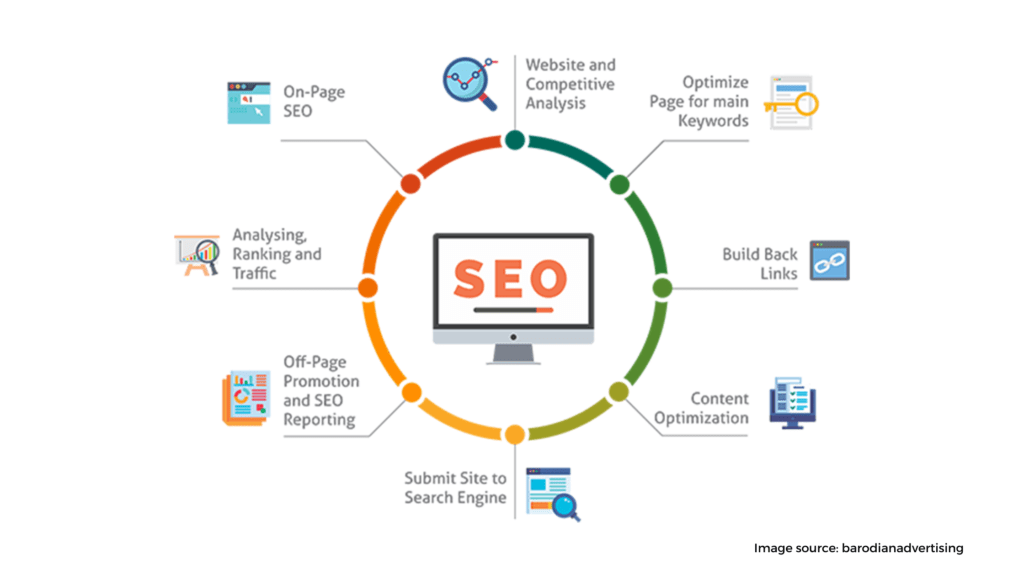

7. Read up on search engine optimization

Are you unfamiliar with the concept of search engine optimization (SEO)? It’s a method for ensuring that your online presence reaches as many new consumers as possible. Here’s how it works in practice. As a certified financial planner , you want to be one of the first financial planners that comes up whenever someone searches for “financial planner in (your city).”

Let’s assume you run a financial consultancy in Bristol. Most likely, potential clients are searching for “financial advisers in Bristol” on Google. Incorporating this phrase into your website in a natural manner, along with other popular keywords, can help improve your ranking (how high up the search engine results page you appear), making it simpler for new leads to locate your company.

SEO is a vast and ever-changing field, and it may be as much an art as a science. The goal of targeting the niche terms that few sites have addressed is to lower competition and improve your chances of ranking. This is an excellent chance to show off your professional know-how.

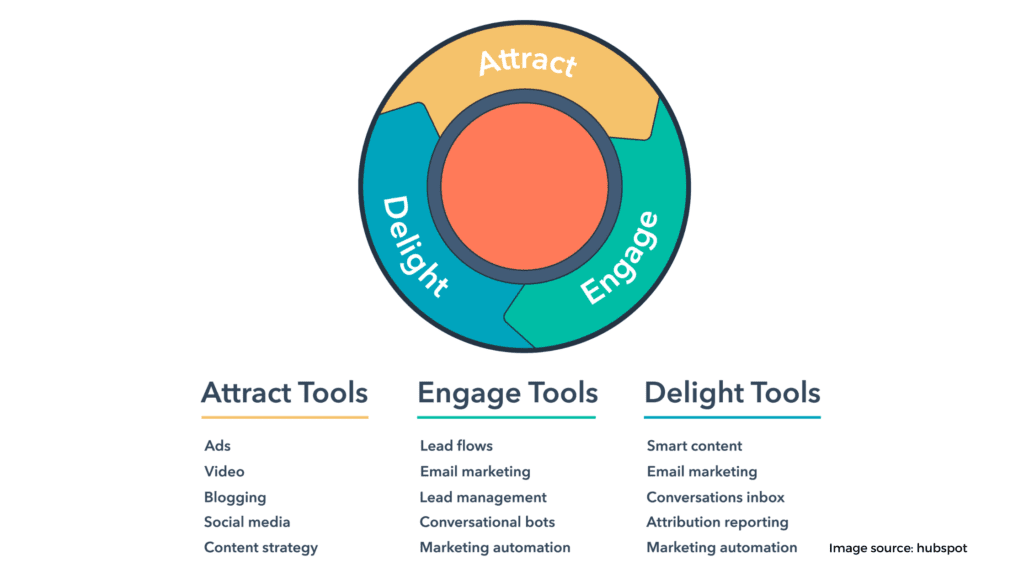

8. Perfect inbound marketing

As compared to outbound marketing, inbound marketing, on the other hand, is a more covert approach investment advisors of enticing their audience to interact with their product or service to help with their financial planning needs. All forms of marketing, from advertising to cold calls and emails, loudly declare that an investment advisor is offering something. Inbound marketing is a style of engaging your audience while also providing them with value for their time by using channels such as blogs and social media sites, which in return increases brand loyalty.

Providing useful information on subjects you’re an expert in, such as retirement planning or investing for novices, will draw new people to your website. They’ll discover something fascinating and you may find a new customer by offering up just a little of your knowledge for free.

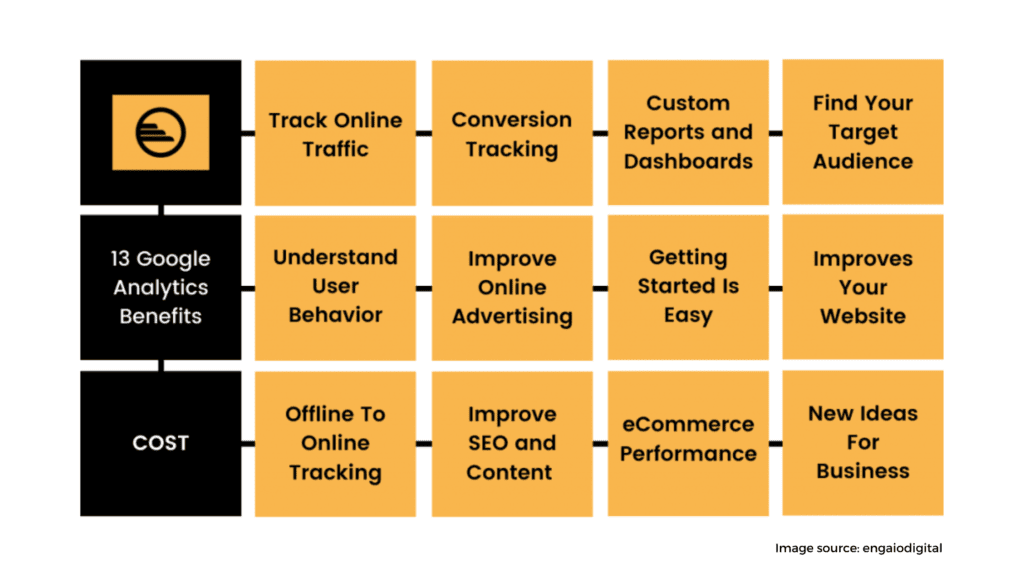

9. Regularly analyze key marketing metrics

It’s a waste of time to spend hours upon hours developing marketing campaigns if you aren’t keeping track of your results. Examine important marketing indicators like interaction, website traffic, and conversion rate before implementing a new marketing research approach. Services of a financial advisor depends on the analysis of certain key marketing metrics. After you’ve raised the bar a bit, you can observe these numbers to see if they’re going up, indicating that you’re doing the correct thing; or stagnating, implying this isn’t the most effective approach to get new consumers.

10. Use lead generation platforms

Are you having trouble coming up with leads on your own? Joining a lead generation platform (such as Unbiased) might help attract new customers to your business. You’ll be placed in front of clients in your local area who want your services, ensuring a constant supply of work.

Furthermore, the excellent reputation of your chosen lead generating site will be linked to your reputation. Customers are more inclined to trust you if they believe that the platform only accepts reputable, experienced professionals than if they discovered your site by accident while surfing the internet.

11. Show your clients they’re appreciated

This is one of the gentlest marketing techniques, and yet it may produce significant long-term results. Take the time to cultivate existing customer connections, and you’ll encourage not only repeat business but also word-of-mouth advertising as they talk about you with their friends. There are several strategies to accomplish this, including:

- Sending out regular newsletters to keep your customers informed about industry developments is a good idea.

- Sending out friendly, no-obligation emails on a monthly or quarterly basis

- In the days leading up to major events (like Christmas, New Year’s Eve, tax-filer season), it is critical to keep in touch.

- Taking high-value clients out to dinner rarely proves detrimental. When you’re speaking with you in a calm setting, new ideas may surface as to how your services may benefit them.

The secret to doing client outreach correctly is to avoid making each email sales-oriented. It’s all too easy to include a call-to-action at the end of every message in order to increase revenue, but it will seem artificial and pushy. Take the time to check in without seeming like you’re rushing someone; simply seeing your name may remind your clients it’s time to schedule another appointment.

12. Join a directory

Being listed in a directory (such as Unbiased) can help you boost your profile. Some clients want to look for their advisor on their own and make their decision, so having this choice as well as a lead generating service could result in twice the inquiries. Furthermore, a well-known directory with excellent SEO may allow you to show up more often in local search results.

13. Seek expert advice

As an IFA, your specialty is essentially personal finance. If marketing isn’t your thing, you’re in the majority. As you would tell your own clients, consulting an expert is usually the finest approach to go forward. You could pay a freelancer or hire a marketing agency to assist you figure out what you’re currently doing well and where some improvement is needed. This should allow you to create a professional-standard marketing plan.