The drive behind small and medium-sized enterprises to experiment with new marketing channels in order to reach their target audience is technological progress. To complement their current marketing tactics, brick-and-mortar firms are adopting digital marketing methods.

You must think about digital marketing in order to reach out to your potential customers. Your company’s digital marketing plan may make or break it in the financial services industry. As a result, you must devote both time and effort into developing and putting in place a successful digital marketing plan to help you improve your SEO ranking and enhance conversion rates with your target market.

Modern-day digital marketing for financial advisors will provide your firm with technologies and methods to help you develop a competitive advantage in your field, as well as enhance your success.

7 Reasons How Digital Marketing Can Help Your Financial Firm

To comprehend how digital marketing for financial advisors works, you must first understand the fundamentals. This includes an understanding of why digital marketing is a viable method to market your company and the many forms of digital marketing available.

Here are seven reasons why digital marketing for financial advisors is so beneficial to their firm.

1. Reach Their Target Audience

Online marketing instruments and real-time targeting are allowing internet marketing to take over traditional advertising channels while also enabling you to reach your target audience.

How are potential customers interacting with your brand? The manner in which you react to these situations and engagements will impact the success or failure of your company.

Interacting with your consumers can provide you direct insight into what they want. You may use this crucial knowledge to steer your decision-making process by making the correct decisions at the ideal moment. It will also assist you in improving the customer experience, fostering positive consumer connections, and, most importantly, growing your ROI.

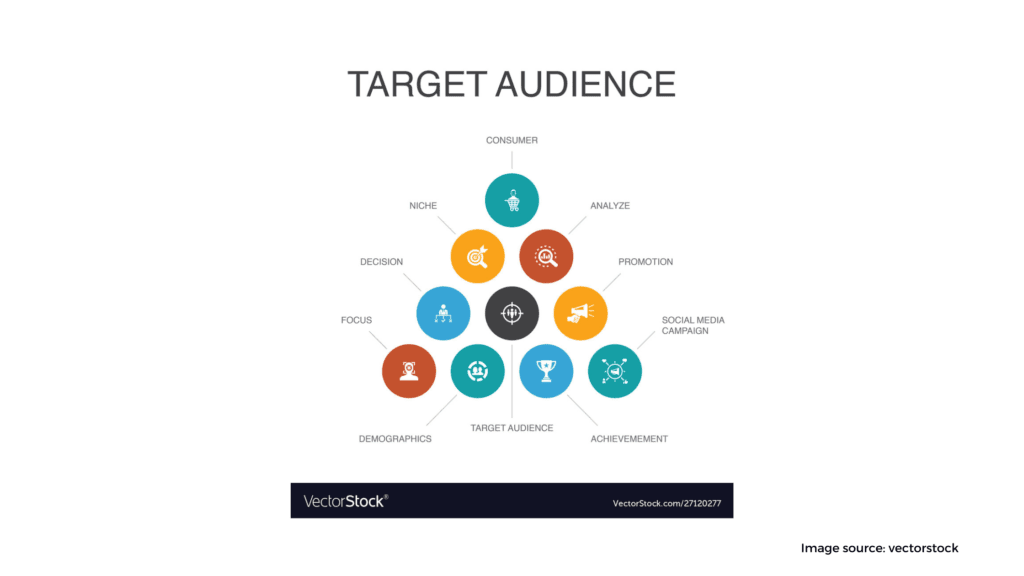

2. Convert Website Users to Clients

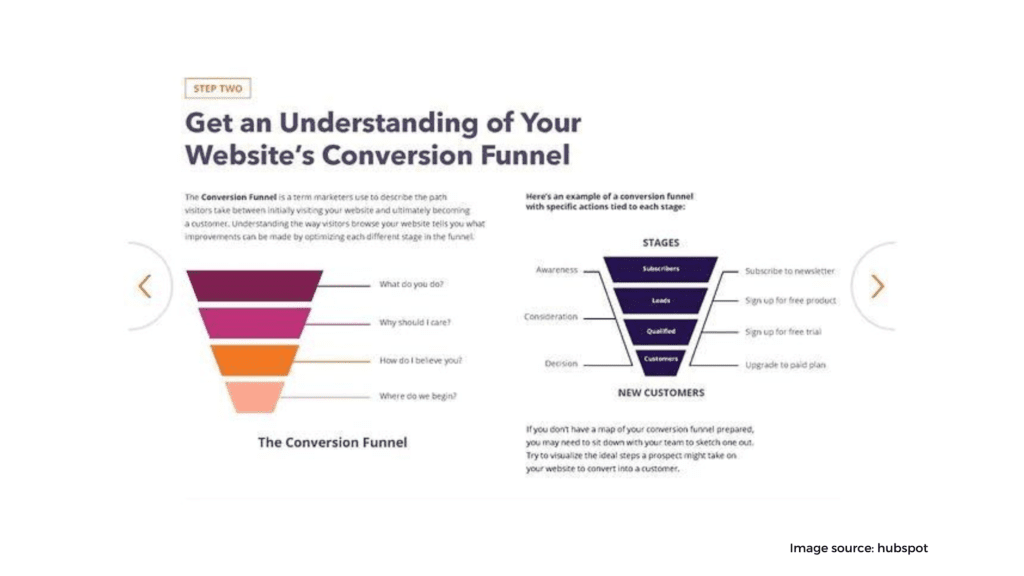

The success of your digital marketing efforts is measured by the number of visitors that come to your website and the proportion of them that convert into leads, sales, and subscribers. It is, however, contingent on what you want to achieve with your website.

You need calls-to-action on your website because you need conversions; without them, all that traffic will be meaningless, and your marketing efforts will be ineffective.

As a result, the major objective of digital marketing for financial advisors is to optimize their digital marketing efforts towards conversion. Conversion optimization is at the top of most digital marketers’ priority lists. Some of the many strategies to improve your digital marketing outcomes include search engine optimization, email, and social media marketing.

3. Increase Conversions

There are several advantages to improving conversion rates through digital marketing techniques. The most significant of them is, without a doubt, increased ROIs.

Many financial advisors and financial services companies with an anticipated revenue development via digital marketing tactics have three times more chances of growing their business. They may reach closer, broader, and farther markets locally and internationally by opening their doors and displaying their brand.

To do so, here are some key points to focus on:

- Create a selling proposition that stands out

- Collect a lot of data on the consumers’ needs and the market you want to target.

- Get a deep understanding of your prospective clients.

- It is a two-way street, so give more to receive more

- Interact with your consumers and be yourself as a brand.

4. Target New Customers

A digital marketing approach helps you attract new potential consumers and take acceptable actions that your company or brand expects them to perform, according to social testimonials and feedback.

Although the consumer maintains control over whether or not to make a purchase, as a digital marketer, you may utilize creative and clever calls-to-action to encourage conversions to sales.

A call-to-action (CTA) is a word or phrase that encourages your new client to make a specific next step, such as subscribe, sign up, download something, buy anything from you. Specific instructions will persuade them to take desired beneficial actions.

As a result, modern website design, forms, phrases, and color schemes will complement each other. This will allow your strategy for financial advisors to give the greatest return on investment for your organization.

5. Increase Brand Awareness

The power of digital marketing for financial advisors is in generating brand recognition to engage new markets and customers.

Customers looking for comparable services are all ready to learn about your business, products, and services. They may have already made a decision to buy, but you simply need to appeal to them enough in order for them to make the purchase.

Promising to fulfill your commitments can help you create stronger client connections. And positive consumer feedback, reviews, and word of mouth exposure through these satisfied clients may lead to increased brand recognition. These clients may become a benefit to your financial business in terms of brand reputation without costing you time, money, or effort. A pleased client is more likely to talk about their experience with your company and services with others. It might help spread the word about your company’s reputation and provide new doors of opportunities.

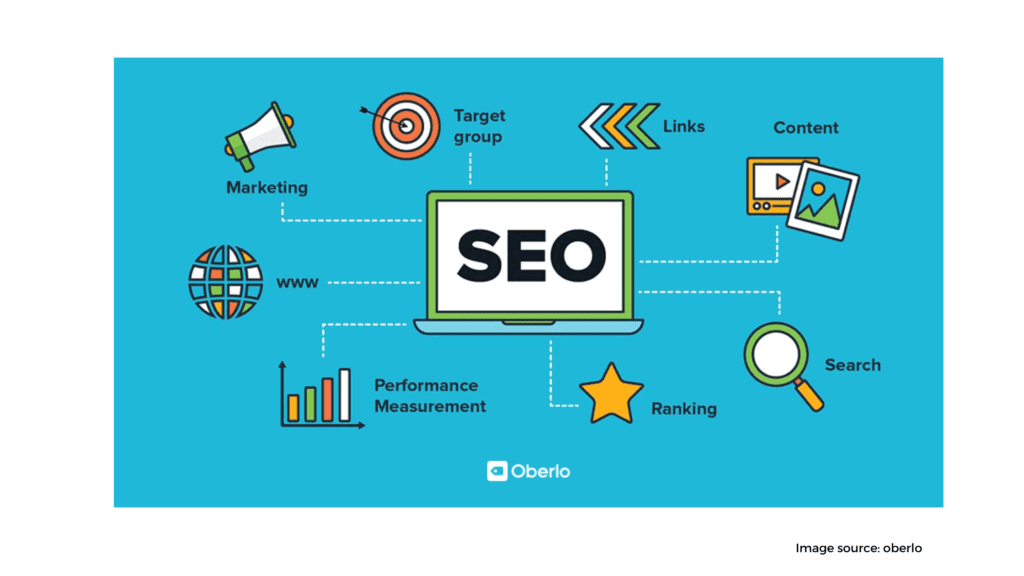

6. Optimize Site for Better SEO

SEO increases the visibility of your company’s website by improving its ranking in search engine results, such as Google.

Google’s search engine is the most popular, and it has a significant impact on how well your website performs. When consumers see your website appear higher in Google’s search results, they are more likely to visit it. As a result, as

Furthermore, a highly rated website may also improve conversion rates and revenue generation.

7. Build Their Portfolio of Clients

The current trend of social media frenzy is fueling digital marketing methods. Smartphones and mobile devices have had a significant impact on consumer behavior, with consumers spending more time on social networking sites than ever before.

Facebook and Instagram are their favorite marketplaces, owing to the fact that uploading their normal routine and looking for all of their requirements is a part of social media such as Facebook and Instagram. As a result, if you work in the financial sector, own a business, or manage a financial management service, you must have a social media presence these days.

This is also the greatest approach to have a more personal and direct connection with your clients. According to a survey, 79 percent of customers want businesses to respond to their questions in under 24 hours by connecting them to their social media company accounts.

Keeping all of the above in mind, it’s reasonable to assume that if you aren’t already playing, it’s time you got started building a digital marketing strategy to reap the associated advantages.

6 Types Of Digital Marketing Strategies

Although there are numerous types of digital marketing tactics, certain ones are more effective than others. As a result, here are six sorts of digital marketing methods that we believe can benefit the financial sector.

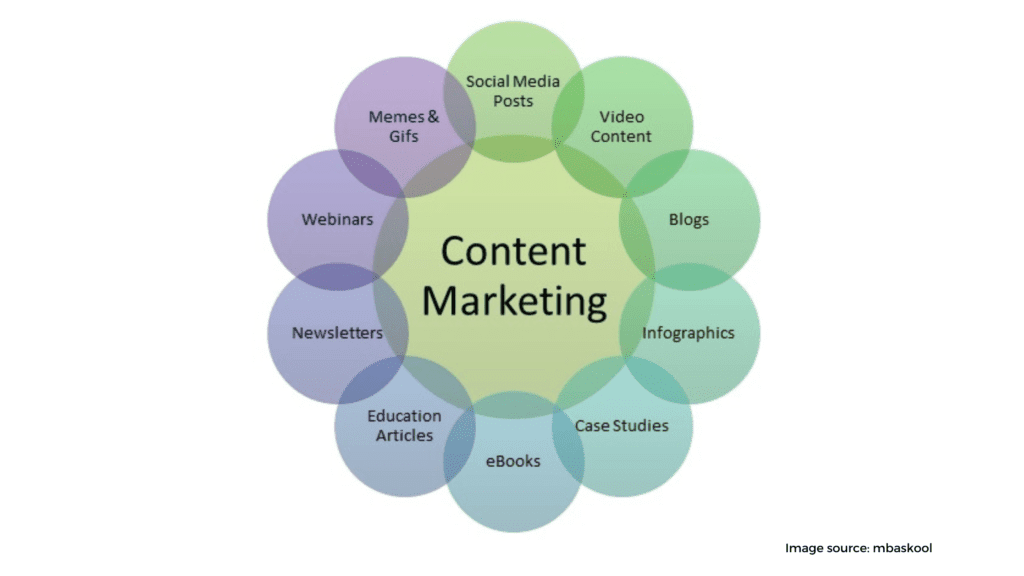

1. Content Marketing

What is content marketing and how does it work? Content marketing is the process of developing and distributing material to promote your company, goods, and services. As a marketer in the financial sector, you may utilize text, photos, and other types of media to create value for your clients.

Blogs, articles, social media posts, and entertaining videos are all ways to do successful content marketing for a Business to Consumer (B2C) firm. You may, however, include reports, white papers, webinars, and instructional videos for a Business to Business (B2B) company.

Some of the advantages of content marketing are:

- This is because it’s all about attracting potential clients to your firm rather than paying to advertise your goods to a cold audience.

- It’s useful for educating, motivating, and entertaining your audience. It also contributes to and supports other parts of your digital marketing plan, such as search engine optimization, social media management, and email marketing.

2. Search Engine Marketing (SEM)

SEO is the practice of optimizing financial advisor website pages for search engines such as Google and Bing. It’s a method for increasing your company’s exposure by having its name appear higher in search engine results than those of competitors. SEO focuses on getting your website to show up as one of the top search results when a user searches for goods or services related to your business.

If you operate in New York as a financial advisor and someone searches for “money services in New York” or “financial advisor in New York,” your name must appear among the top results.

It may be done by employing SEO techniques such as natural and organic searches. You may also utilize sponsored search strategies such as pay per click (PPC), among other things.

3. SEO

Creating content that customers are actively searching for is the goal of internet marketing. However, in order to be successful, you must make sure your material is on the platforms where consumers tend to look for it. To be honest, every firm and sector should focus on SEO since it allows you to have a competitive advantage over others when it comes to expanding your market.

Two of the biggest benefits of SEO digital marketing strategy are:

- It is cost-effective

- When your company is listed in the top search results, it improves brand recognition. It gives consumers a feeling of familiarity and trust in your business.

Do some keyword research and see what people in your niche are searching for so that you may incorporate this information into your content to improve your Google rankings and other search engines.

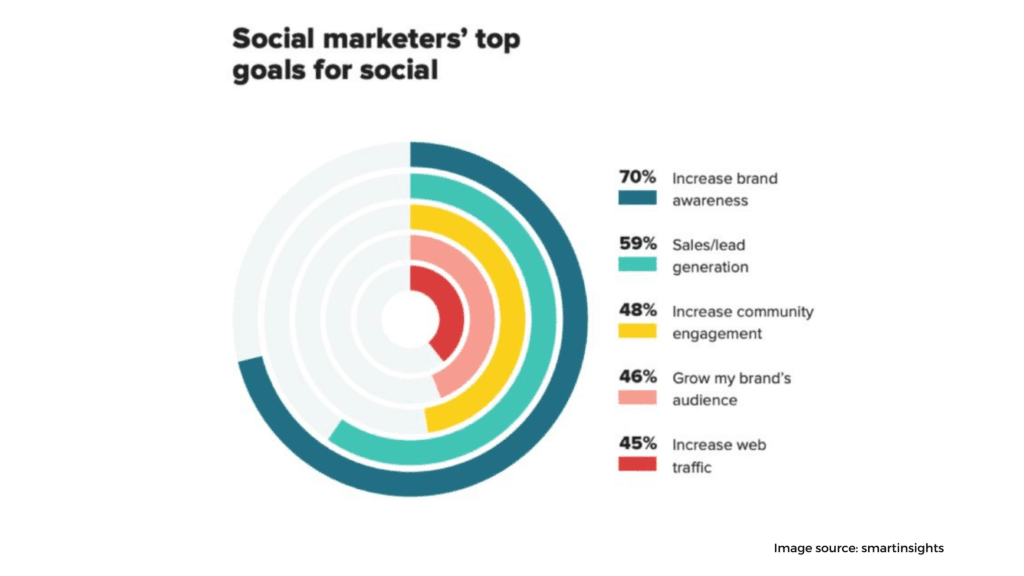

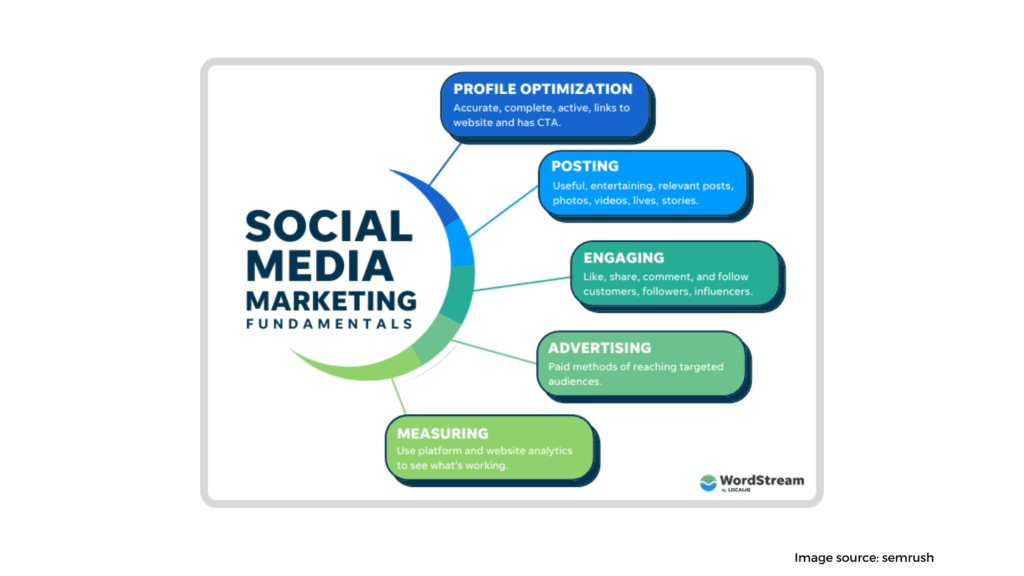

4. Social Media Marketing

You have a one-of-a-kind opportunity to engage with your consumers on social media platforms. It adds a whole new layer of engagement to your client interactions.

Instead of just releasing a financial advisor marketing message to a large audience, you may engage with all of your consumers (old and new alike) and hear what they want or have to say. There are several methods for utilizing social media for marketing, including Facebook, Twitter, Instagram, YouTube, Snapchat, LinkedIn, and others.

To get a financial planning post, video, or other piece of content to go viral, create a Facebook group, company page, or Instagram story. You may also utilize paid tools like Google Advertisements and Facebook Advertisements as an alternative to conventional digital marketing for financial advisors.

The two main advantages of social media marketing are:

- Your work is shared without you having to do anything because more individuals like or comment on it and share it with family, friends, and acquaintances.

- Advertisements on Google and Facebook are extremely complex, and you may target particular clients with your material based on their location, age, industry, language, level of education, or other factors.

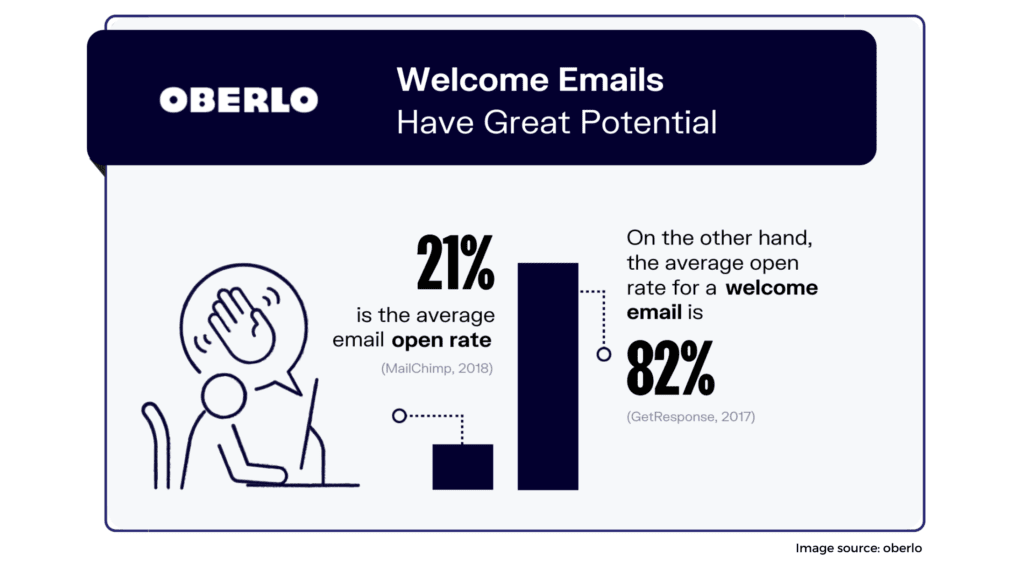

5. Email Marketing

Emails may sound old school, but they are still as relevant as any other modern financial advisor marketing ideas. Ecommerce sites, retail brands, and financial service companies succeed greatly by using email to offer seasonal discounts and specials to both new and existing consumers.

Assume you are a financial adviser who is looking for ways to engage your existing and potential clients with promotional packages and services during tax refund season.

You may enrich your prospects by sending them email newsletters. This allows you to provide a lot of value while avoiding being pushy about selling your products and services or appearing desperate to make the sale.

The main benefits of email marketing are:

- You may use an existing mailing list to stay in touch with your clients. As a result, you will avoid making cold calls to individuals who don’t know you. Furthermore, because the recipient of your email has chosen to receive marketing and news from your firm, your email will not be filed into a spam folder.

- Keeping in touch with the clients maintains your connections while also maintaining your company on their minds should they need to buy.

6. Video Marketing

Video marketing content is essential in today’s digital marketing methods. Video marketing, if anything, can assist you get the most out of digital marketing.

You can make a short video or a longer video message. It may be instructional or amusing; you may even broadcast live in real time.

Some of the benefits you can reap through this mode of digital marketing are:

- Using persuasive and engaging content, you may build an emotional connection with your audience. A video message is also more likely to stay in their memories than a picture or plain text.

- Video marketing is now easier than ever before thanks to the proliferation of video-sharing platforms such as Facebook, Instagram, Snapchat, and LinkedIn.

Do you know of any businesses and brands that have outstanding video content on their social media feeds that improve their position in search engine results for their field?

Conclusion

There are various digital marketing ideas for financial advisors, and the ones we’ve discussed are merely a few of the most commonly used and effective methods. The most important aspect is to be consistent with your content and message while also providing value to your clients and prospects.

You should also avoid becoming too salesy in your approach as that will turn off more people than it will attract. Instead, focus on solving your target audience’s problems and being a resource they can trust.

When you have a strong foundation, you may then begin to experiment with other ideas to find what works best for you and your firm. There are digital marketing services for financial advisors that can assist you in building a campaign tailored to your specific needs.