The marketing of financial planning is in transition. The digital competition has never been greater than it is now, as more individuals make financial decisions online.

Financial services marketing has gone through a dramatic shift as a result of digital transformation, bringing you closer to your customers than ever before. Getting these connections correct at each step of the consumer’s path is critical for digital marketers when it comes to financial planning marketing. Financial advisors need to focus on inbound marketing methods that attract their target market through beneficial and helpful content. Social media marketing , email marketing, and SEO are all significant in helping advisors connect with individuals who may be interested in their services.

Is your Financial Services business competing online?

If not, you may be missing out on key opportunities to reach a wider audience and attract new clients.

In order to stand out in the digital world, your marketing strategy must be sound. It should be built on a strong foundation that can support your long-term success .

There are many essential elements to include in your financial services marketing strategy, but these five are critical:

1) SEO-Optimized Financial Advisor Website

2) Compelling Content

3) Presence on Social Media Platforms

4) Email Marketing Strategy

5) Pay-Per-Click Advertising

Let’s take a more in-depth look at each of these essential financial advisor marketing ideas.

1) SEO-Optimized Website: In order for your site to rank high in search engine results pages (SERPs), you’ll need to make sure it’s optimized for search engine optimization (SEO). This means including relevant keywords in your site content, as well as making sure your website is mobile-friendly and loads quickly.

2) Compelling Content: Your website content needs to be interesting and informative if you want visitors to stick around. It should address the needs of your target market and provide them with valuable information. financial advisor blog is a great way to generate fresh, relevant content on a regular basis.

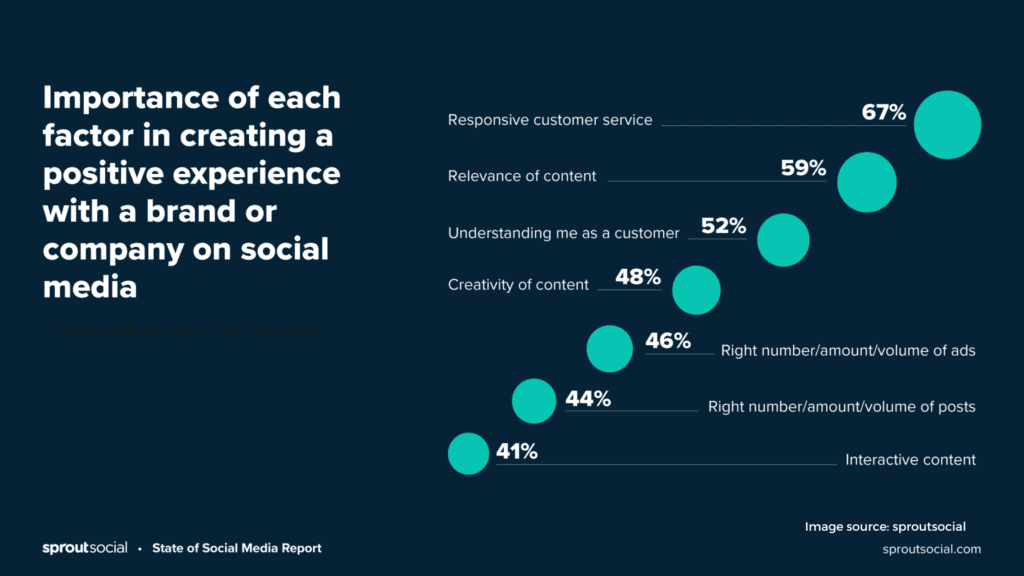

3) Presence on Social Media Platforms: Social media provides an excellent opportunity for financial advisory firms to connect with potential and current clients. It’s also a great way to build brand recognition and share your story and build trust with your social media followers. Make sure you’re active on the platforms that your target market is using.

4) Email Marketing Strategy: Email is a powerful marketing tool for financial services companies that can help you stay in touch with your clients and build relationships. Make sure your email marketing strategy includes a way to capture leads, as well as automated emails that keep your clients engaged.

5) Pay-Per-Click Advertising: Many financial advisors utilize this approach. Pay-per-click (PPC) advertising can be an effective way to drive traffic to your website and generate leads. When done correctly, PPC can be a cost-effective way to reach your target market.

Digital Transformation in the financial planning industry

To reach and convert financial services consumers, you need a well-defined value proposition that is effectively conveyed and backed up by digital technology. Many finance firms are adopting next-generation technologies to mitigate growing expenses and accelerated tempo pressures following COVID-19.

As a result, marketers are operating in an era of technology progress, greater technological productivity, and platform modernization. In these times of change, marketing executives must assume the position of the client and maintain these essential stakeholders at the center of every business decision.

This isn’t a one-size-fits-all case. In fact, as the preceding article demonstrates, there may be applicable lessons to be learned in the world of technology. The tech ‘platform’ architecture, for example, can also be used in the financial services sector, or retail. As outlined below, this is not limited to the business-to-consumer world, but also has applications in the business-to-business realm.

In the banking scenario, the customer journey platforms represent a customer’s encounters with financial products and services – what they want and use. While not all Core IT platforms are ‘marketing owned,’ they do enable these procedures from the client perspective.

Customer experience management and targeting are also influenced by the majority of CMS/ECM platforms, as well as public cloud services such as Amazon Web Services. This includes information from customer support channels, chatbots, social media posts, and reviews in addition to marketing data.

Streamlining these platforms’ operations so that they can operate more successfully and profitably is the goal of Digital Transformation.

Plan your financial customer lifecycle using the RACE Growth Process

RACE is a strategic planning process that can be used to manage and digital transformation of your marketing efforts. It stands for Reach, Act, Convert and Engage.

Reach: To increase the number of people who are aware of your brand and understand what you do (your target market).Act: To turn prospects into leads by getting them to take action, such as subscribing to a newsletter or requesting more information.

Convert: To convert leads into customers by persuading them to buy your product or service.

Engage: To keep customers coming back by building relationships and creating loyalty. The first step is to set your overall objective, which could be anything from increasing awareness of your brand to

In the face of Digital Transformation in the financial marketing sector, I strongly recommend that you approach your financial marketing planning using the RACE Framework. RACE marketing planning allows you to review your digital marketing strategy over the entire financial customer lifecycle.

The RACE Framework is crucial to your financial marketing plan because the content and distribution methods you use will be different according to the stage of your relationship with the customer. See the below, taken from our Digital strategy success factors Learning path.

So, how can you kick-start your financial services marketing? The answer is, of course, a data-driven, strategic marketing plan. That’s what we’re here for today.

This strategy has five components and details the deliverables for each. If you believe that one area of your financial services organization is weak, you may choose to concentrate on it more, or arrange a plan that covers all five elements.

- Performance review and marketplace analysis

- Set vision and objectives

- Define strategy and governance

- Segment and target

- Define OPV and experience

Financial marketing performance review and marketplace analysis

You may have heard of the term “SWOT,” but what exactly does it mean? In a nutshell, it’s a tool that helps you analyze your company. SWOT analysis compares internal strengths and vulnerabilities with external possibilities and threats in the financial sector. We also suggest that Smart Insights members utilize the TOWS resources to strategize their operations. As a financial advisor looking for prospective clients in the financial services industry, it’s important to understand your target audience.

That involves creating buyer personas, which are semi-fictional representations of your ideal customer, taking into account factors such as their age, income, location, and interests. Once you’ve created your buyer persona, you can start thinking about how to reach them through various channels. Are they more likely to read industry news online? listen to podcasts? or attend webinars?

The TOWS matrix assesses internal strengths and limitations (green) and external opportunities and threats (blue) around the edge, as well as four main boxes for developing market strategies.

Set vision and objectives for marketing your financial services to customers

It’s critical to plan your financial marketing vision and goals in tandem with your overall strategy. Keep in mind what metrics you’ll be using to track progress. The educational mnemonic VQV may assist you in defining the metrics used to rank on a volume, quality, and value basis.

REACH metrics such as unique visitors can only show you so much – whereas the bounce rate and the revenue per visit are much better indicators of the quality and value of your visitors.

However, merely recording sales volume is insufficient in assessing the success of your CONVERT marketing. The percentage conversion to sale or sales value is one way to assess the quality and value of your sales.

Segment and target your financial services business’ key customers

The true value of digital marketing becomes apparent with segmentation and targeting. The degree of precision targeting available to today’s marketer is remarkable. Consider this in the context of the customer lifecycle RACE Framework, and you’ll get a glimpse at just some of the possibilities that RACE planning opens up.

Financial planning marketing real-life example

In the following scenario, segmentation and targeting may be used on marketing data throughout the customer ENGAGE experience.

You can use financial marketing ideas flux to your advantage if you have the required strategic plan in place for potential clients.

Conclusion

Financial services marketing is essential for any business in the industry. The process can be daunting, but if you break it down into manageable steps, you’ll be on your way to success in no time.

If you need help getting started, or would like some assistance along the way, there are digital marketing services that can help you with your financial services marketing needs.

Digital marketing for financial services is a complex and ever-changing landscape, but with the right mix of strategy, creativity, and technical know-how, your business can navigate it successfully. Keep these tips in mind as you develop your own digital marketing plan, and you’ll be well on your way to reaching your target clients and growing your business.