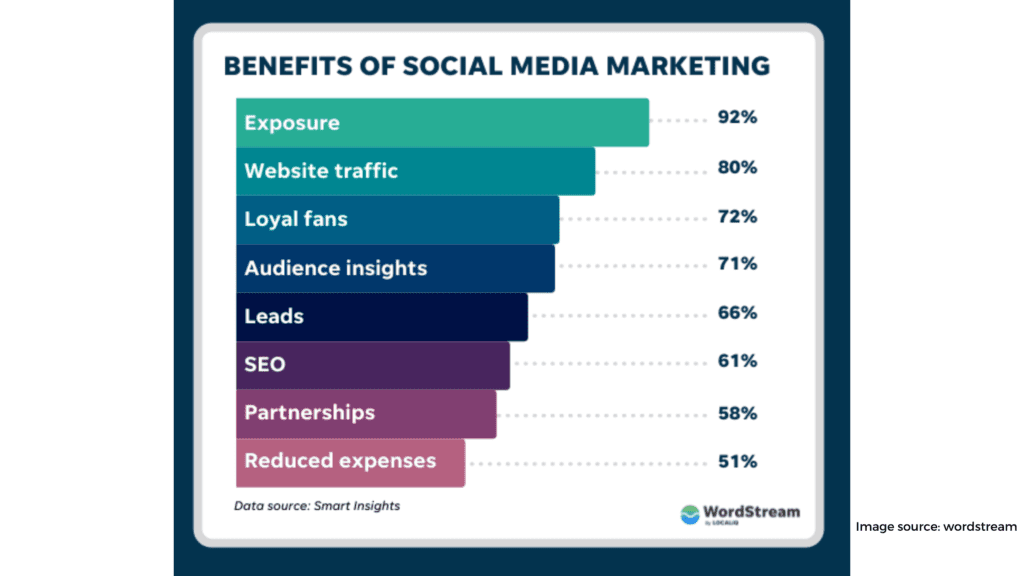

Marketing a company’s goods and services is required for it to develop. The financial services sector, like any other, isn’t immune to this trend. Social media has now become a permanent part of our culture, and it can be successfully utilized as a marketing tool for any certified financial planner. Financial advisors may use social media as part of their digital marketing strategy to get in front of more prospects and expand their client base.

The Importance of Social Media Marketing for Financial Advisors

Financial advisors are particularly interested in social media since more and more people look to it for investment advice. Don’t trust me? According to a Sysomos (a social media software provider) and Marketwired (a business news data channel) study, between 30% and 40 percent of all investors used “traditional” methods such as newspapers, analyst reports, and so on to get investment information. That means old-fashioned sources like as the newspaper are being used less and less as time goes by.

According to a recent study, about 60% of investors surveyed said they used social media information when making investment decisions.

According to a recent study from Accenture, over half of financial advisors use social media to communicate with investors on a regular basis. That means at least half of financial advisors aren’t doing it, and that’s terrible.

Even worse, 9% of investors polled by Accenture believe that investment advisors that don’t use social media would lose clients. What if I reduced your take-home pay by 9% right now? That’s exactly what’s happening, and the scariest part is that this number is only going to rise.

Wait… How Does Your Website Look?

In terms of business and profit (which is the objective here), social media is designed for you to create leads. Financial professionals may generate leads by sending them to their financial planning services website, where they will perform whatever action they want them to do – To gain an audience of interested people, you need to spend time and effort attracting them through market research. Whether it is email marketing research like signing up for an email list, a free report, or arranging an appointment with you, it takes time and work to convert leads into customers.

That’s why it’s critical for you to get your website in order before sending out a single visitor. Don’t you clean your house before inviting guests over for supper? Well, I hope you do, but if you’re like me, cleaning is more of a “sweeping” activity than anything else.

But you don’t want visitors to conclude things like, “I couldn’t figure out what was going on” or “I had no idea what to do.” Your aim with social media is to get people to visit your website. The goal of your website is for visitors to become leads. If you can’t accomplish that, your inbound marketing machine will be a failure.

When Should You Post On Social Media?

This is a frequent concern that I hear from financial advisors about social media marketing. When it comes to marketing, however, there are no hard and fast rules. Have you ever noticed that the most cringe-worthy infomercials tend to air around 3:00 a.m.? What’s going on here?

I’m not sure, but if I had to guess, I’d think that sellers in the infomercial industry are aware that people who are most likely to buy their goods are watching TV late at night and early in the morning. Maybe we have poor judgment in those early hours… who knows? So, if you’re up at 3 a.m. watching TV, you’re probably a target for them.

But what about your prospect? Here are some rules of thumb:

- The best time for click-throughs averages around 1 to 4 p.m.

- On average, Wednesday has been proven to be the best day

- On the weekends, between 8 p.m. and 8 a.m., the worst time for click-throughs is generally when

Take these figures with a grain of salt. I am NOT suggesting that you only post to social media during those hours because I don’t want you to do nothing. What I’m trying to say is that the best average is something.

If you’re a financial advisor that focuses on dealing with teachers, you probably don’t want to follow this advice because your target audience will be students in school at the “best times.” Use common sense and adjust your strategy to match your market.

Instead of trying to determine when is the “perfect moment” to publish, learn more about your topic.

Social Media Marketing Tips for Financial Advisors

1. Know Who You’re Targeting

You may reach millions of individuals with social media. The actual marvel of social media, on the other hand, is when you know, ahead of time, whom you want to market yourself to.

Thousands of groups exist on both Facebook and LinkedIn. These are locations where people who share a similar interest congregate. If your target market is made up of these individuals, you should spend time with them wherever they go.

Furthermore, many social media sites provide hyper-targeted advertising that can be directed to the precise kind of individual you wish to target. Someone I know sells coloring books for adults, for example. He discovered that his product’s ideal consumer was a 34-year-old woman who enjoys meditation AND yoga. Because of social media, he may utilize “layered targeting” (where he only targets individuals who like both meditation and yoga) to create an extremely targeted marketing campaign.

When you advertise, you want to concentrate your efforts. Because the more people you reach out to, the less likely it is that you’ll receive a high level of engagement. The more expensive your advertising becomes if you don’t achieve high levels of engagement.

2. Engage with others and respond to prospects’ queries.

Social media is never actually “off,” so if you only log in once a month, you’re losing out as an investment management advisor. If you continue to post interesting stuff related to financial life and financial goals on social media, you must keep track of how people react and provide comments.

If you’re doing social media “properly,” it’ll naturally lead to real connections. I don’t mean taking pictures of every meal or Snapchatting everything you do all the time. What I’m talking about is informing the world about your company’s progress – have there been any recent successes, obstacles, dips, or accolades? Viral marketing refers to content that people are so compelled by they can’t help but share it with their social media networks.

Furthermore, having a strong social media presence helps to enhance brand loyalty. According to a research by Texas Tech University, companies that are active on social media have more devoted consumers because they are constantly engaging and interacting with them.

3. Leverage any charitable functions, events or press.

as part of your marketing strategies, post it on social media if you’re organizing a charity event, attending a large trade show, or offering your services at a good cause. You could even be featured in the news depending on the time and place.

Please avoid getting involved with charities simply for exposure, however. When you don’t seem genuine, people can tell. I think it’s the correct thing to do and that people can see my enthusiasm when I volunteer to provide low-income schools with supplies and resources.

If you are selected by a news organization (assuming it’s for something good), share the news on social media. This is referred to as “newsjacking,” and it helps to draw attention to you.

4. Learn about your prospects, clients, and competitors.

You may learn a lot about other people by looking into their lives on social media. Whether it’s the young lady photographing her expensive Starbucks beverage or your neighbor with the Mercedes S-Class (you’re not sure what he does for a living…), all of these networks provide us with a look into others’ values and activities.

When you understand your prospects and clients better, you can come up with more talking points for when you speak with them. It also allows you to stay ahead of them during their non-phone interactions or visits to your facility.

In the identical way that financial advisors can get information about their prospects and clients, they may also find out about their competitors. Is one of your rivals performing well on social media? Is it apparent that his or her postings receive a lot of engagement while yours are icy cold? When this occurs, you should take time to think about what they’re doing differently than you.

When it comes to generating leads, social media is only one piece of the puzzle. Once you figure out which subject areas are effective for your target audience, you can apply that knowledge to other channels like your website, direct mail pieces, email marketing, and more. Because if someone connects with your niche on one platform, they’re likely to do so across others as well.

Take a look at what they have on their Facebook page, who they follow, who follows them, and which of their postings are most popular. This will assist you in determining what is working for your competitors and why they’re successful with social media.

5. Use it for content distribution.

The real power of social media is its scalability. If you have relevant content, you may reach thousands of people quickly. You can showcase your products and services in your content such as investment advisor tips, personal finance tips, financial planning needs, exchange traded funds, etc.

You don’t need a large audience to advertise on Facebook. If you’re looking to promote an article about preparing for retirement in your fifties, you can simply target it exclusively to people in their fifties using Facebook advertising. You might also share that material with those who already follow, like, or connect with you. This has never been done before.

LinkedIn’s coolness factor is through the roof thanks to Pulse. If you’re unfamiliar, Pulse is a LinkedIn publishing platform that allows users to create their own articles. It’s what you see when you click the “publish a post” button in your status update. Because it enables individuals to show off their knowledge to interested audiences, Pulse stands out in social media.

Sending clients from social media to their email opt-in page is one of the most helpful things financial advisers are doing right now. This works well because it draws people away from “rented land” (after all, you don’t control social media) and onto “owned land” (because you DO control your email list).

Using social media for content distribution is extremely advantageous since it allows your prospects to sample your message in a variety of locations. Continuing with the email example, the prospect may receive an email from you in the morning and see you every night when they log into their social networks. This excels at creating market familiarity.

The second reason to use a video in your email campaign is that, after the first few days, it will have raised awareness and gained interest. As a result, this allows you to overcome doubt and skepticism. Because a prospect may start by interacting with you on social media but then avoid contacting you directly because of suspicion. However, once he or she sees your website, joins your email list, and so on, they are more inclined to accept you as genuine.

6. Pay attention to your company’s social media policies.

I’m not going to lie to you: many financial firms are far behind in terms of social media. It baffles me that some of these businesses still operate in the stone age. However, if you work for one of these firms, you must follow their rules.

For example, many businesses have strict restrictions on LinkedIn recommendations. That’s a good policy since it avoids the appearance of a testimonial. Another issue is that you can’t create, publish, or advertise content.

Certain businesses only allow you to post material from a pre-approved library of content. It’s monotonous, and I get tired of seeing the same old boring status updates from advisors who work for these firms. If that’s the business you picked, you must comply.

7. Don’t forget about your bottom line.

Okay, enough with the cute stuff. Let’s get down to the nitty-gritty.

I believe this is the most crucial advice since financial advisors will be using social media for commercial purposes in this context. And, if this is the case, making money is the objective.

“Building a community” is appealing, but being profitable is preferable. You’re doing it wrong if you’re solely concerned with metrics like new likes, comments, reach, and so on. You can’t deposit “likes” at the bank. This is what you should concentrate on when it comes to social media:

- How much does it cost you to acquire a lead?

- How many leads did you generate?

That’s pretty much it. Please do not hesitate to contact me if you have difficulties obtaining a positive return on your social media efforts. But I’m not going to feed you a bunch of smoke and mirrors; ultimately, you need to know how many leads you can produce and whether or not you’re profitable at that cost per lead.

Let’s assume you’re running a Facebook ad right now and directing people to a piece of content with an opt-in form so that they can book a meeting with you. Let’s also suppose that each click costs you 50 cents and that out of every 40 clicks, one person books an appointment. Now let’s do some arithmetic…

A Few Things I’ve Learned From Working With Financial Advisors

To begin with, most financial advisers are largely unengaged on social media. The few who utilize social media are killing it.

I’ve noticed that many financial advisors seek to cater to the needs of everyone on social media. For example, they will post content regarding budgeting, saving, retirement planning, and so on that applies to everyone. This method is ineffective in driving change.

The key to making social media effective for financial advisors (and work really well) is to focus on a specific topic and interact with those who are interested. Because it is simple, it may appear as such.

Imagine a financial adviser who has 5,000 connections on LinkedIn but no specialty. That advisor may talk about general things all day long and may or may not get any attention.

Compare that to a financial advisor who focuses solely on teachers and has only 2,500 connections on LinkedIn. If the above financial advisor publishes a blog post about “7 Retirement Mistakes Teachers Make,” he or she will receive far more engagement and appointments as a result of that material.

By the way, you don’t have to share your stuff and interact with other people on social media in order for it to work. I’m aware of certain businesses that prohibit that sort of participation. The key is to select a market and go where the market congregates.

Conclusion

It’s not about being an “influencer” on social media. It’s not about generating goodwill or providing “value!”… no matter what the social media goliaths tell you. For financial advisors, social media is all about locating prospects and getting them to set appointments with you. Period. You should have your social media accounts in place to make that happen.