Financial advisors, like any other business, require a strong digital marketing strategy. Discover which marketing techniques this sector should use.

As a financial adviser, you are undoubtedly aware of the fact that your industry is highly regulated, with numerous federal regulations dictating what you can and cannot say or do.

However, this does not indicate that you won’t be successful in marketing yourself online and obtaining the leads you desire.

Because many financial advisors will not devote much time or effort to digital marketing, you have a unique chance to gain an advantage over your competition.

So, what financial advisor marketing ideas tend to work best?

Why is Marketing Essential for a Financial Advisor?

Financial advisors and financial services companies should market their product because it will assist develop their firm.

If you want to grow your business, you’ll need a solid marketing strategy. If you don’t have a well-defined plan, you may find yourself stuck in neutral rather than reaching your growth objectives.

From developing a strong brand to participating on social media, marketing allows you to reach out to your target demographic.

While you must still rely on recommendations and face-to-face interactions, focusing on marketing allows you to better identify your ideal target market, clarify your brand messages, set objectives, increase your ROI potential, attract and convert prospective clients, and much more.

Think about it: more business will generate to more revenue. As a result, the more you can expose yourself to the appropriate individuals, the more likely it is that your client base and bottom line will expand.

Thankfully, the internet has made things more accessible and possible for us to do just that.

5 Financial Advisor Marketing Strategies You Need to Know

It’s time to look at a few particular marketing techniques that you can use now that you know what the right marketing plan can accomplish for you.

#1: Get Your Brand Together

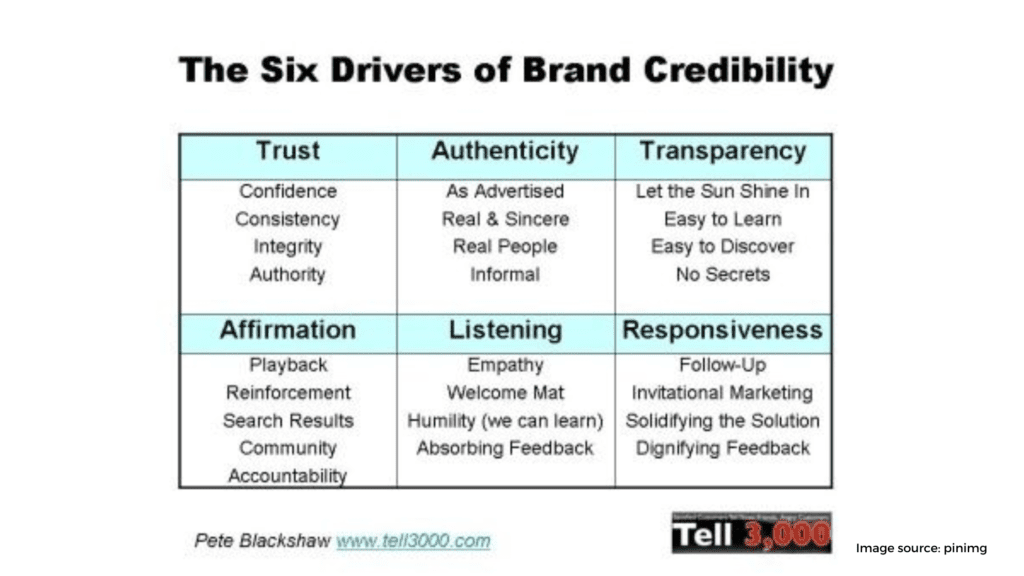

You must first ensure that your brand is on track in order to create the ideal marketing plan. This includes everything from your name and logo to the message you want to send out to your target audience. Brand recognition is a fundamental part of any marketing strategy in the financial services industry.

Your brand must be professional, display your personality, and fit in with your company’s culture.

However, it must also be clear in its meaning and why your customer should select you rather than one of your rivals.

A financial advisor website should have a modern, sleek design that is also easily navigable. Above all, make sure your website is mobile-friendly as over 60 percent of web traffic now comes from smartphones.

Your website will serve as the foundation of your digital marketing strategy and must accurately reflect both you and your brand.

One way to create a strong brand identity is consulting in digital marketing services . This will help to ensure that your branding is on point and that your marketing strategy is as effective as possible.

Another idea is to focus on creating blog content.

But no matter what, make sure that you have a strong handle on your brand before moving too far ahead with any other marketing plan items.

#2: Identify Your Niche and Market

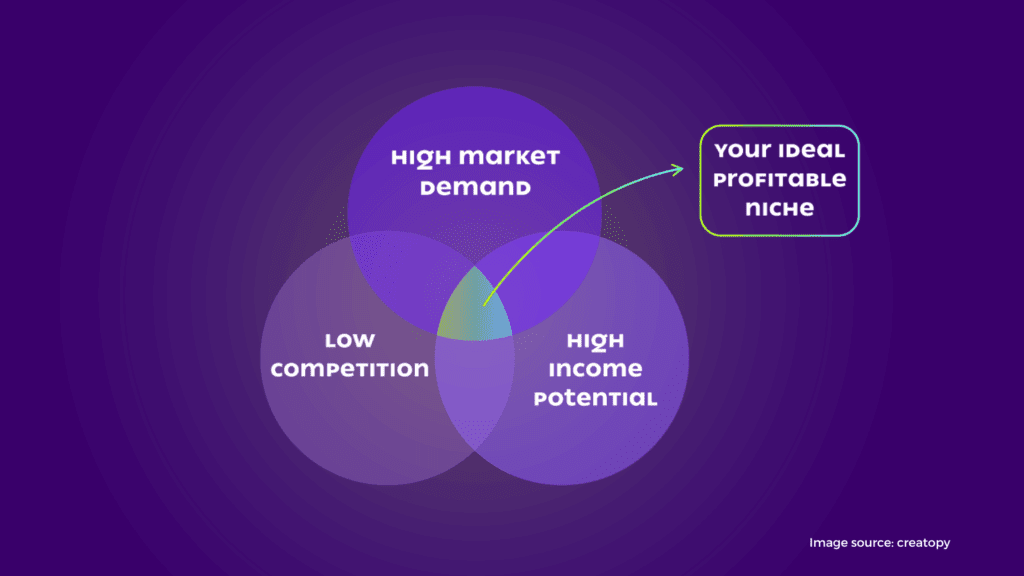

To get ahead of the competition, you must first know where you stand in the market. This will allow you to set yourself apart from the crowd as a company and more precisely target all of your digital marketing efforts.

Financial advisory firms should focus on a niche market or target a specific demographic.

For example, you may want to focus your attention on women who are starting their own businesses.

Or maybe you want to help people who are nearing retirement age and need to start planning for their future.

You could also decide to focus on a certain type of investment like real estate.

For example, potential clients seeking financial management advice will be a distinct demographic (age range, etc.) from someone searching for information about retirement planning and long-term care.

The last thing you want to attempt is to make concessions for everyone. If you go down this road, it will be much more difficult to develop your company.

New clients will visit your website feeling unsure if you can assist them with their problem. This is due to the large number of distinct services offered by your business.

In the end, you will wind up reaching virtually no one.

The more focused your message is and the more precise the audience you choose, the more effectively it will resonate with prospects and cause them to contact your financial firm.

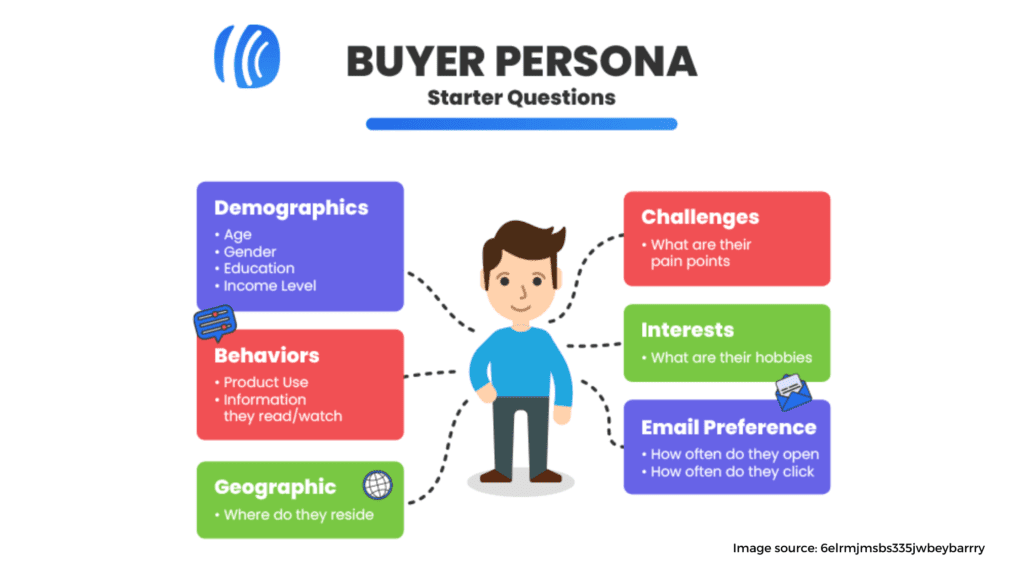

Take the time to develop a picture of your buyer persona.

After that, adapt and choose the right marketing strategy to fit the ideal customer and ensure they’re in a language they can comprehend. Otherwise, they may become dissatisfied and move on to another business.

When it comes to digital marketing, specificity is critical. Your overall marketing efforts will have a greater return on investment if you are specific.

#3: Get Social

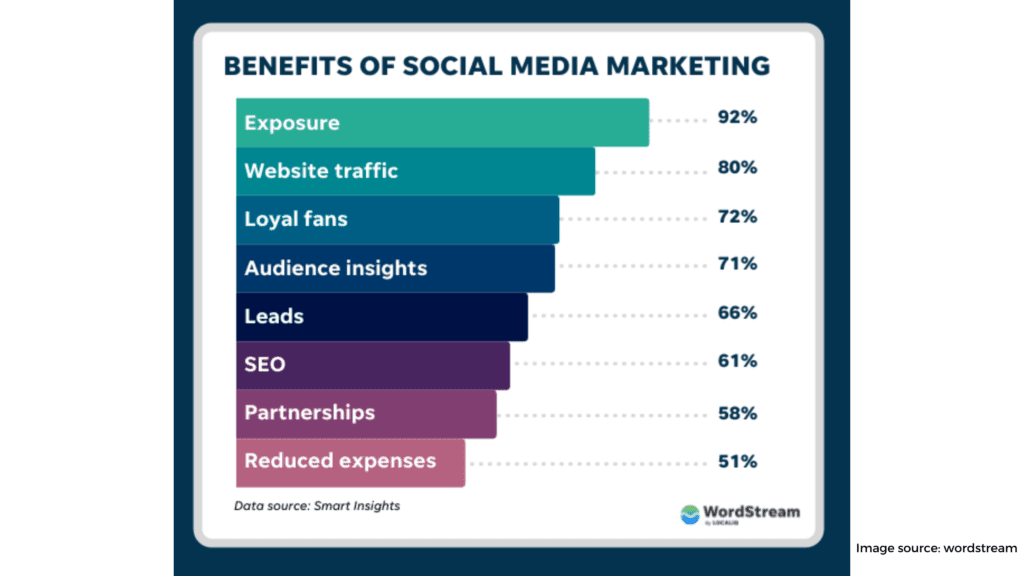

The ability to reach a large audience is one of the advantages (and disadvantages) of social media.

You used to have to rely on cold calls, recommendations, and the like to reach out to potential customers. The ability to make connections and increase brand recognition is now available through social media platforms.

It’s a wonderful way to share information about your company, attract leads, and interact with customers who are keen on financial planning.

If you’re utilizing social media to your advantage, it’s critical that your brand message is consistent across all of the platforms. This will appeal to your social media followers.

Now, as a financial advisor, you may need to utilize some underhanded tactics in order to get your material out there and in front of your target audience, owing to the rigorous SEC and FINRA regulations.

You should be cautious about what you put on social media, and you should aim to be as generic as possible. The wrong statement may easily be misunderstood as financial advice. Likings, comments, shares, and so on fall within this category.

Here are a few ways to get out from behind all of this:

- Make good use of hashtags that are relevant to your material. #weatlhmanagement, # retirement, #financialadvisor, #financialwelness, and so on are but a few examples.

- Create a landing page for each business and use it to generate leads.

- Include third-party information, such as material from other reputable financial blogs.

- Relationship building, which is simply a component of the overall sales process and involves selling to clients.

Finally, consider using social media to market your business. Even though you want to post frequently and regularly for your clients, go for quality instead of quantity. Leverage social media to show off your company’s unique voice and personality.

Ideally, you want to be seen while also providing information that may be beneficial in some manner or another.

#4: Craft and Send Regular Newsletters

People look for financial advice on a daily basis, so if you aren’t currently sending out a regular newsletter to both clients and possible clients, you are missing out on a significant opportunity.

For one, it’s all but certain that your competition is. This implies they are constantly reminding the customer of their brand.

The more a customer becomes familiar with you, your company, and your services, the more probable it is that they will seek you out when they have a financial-related issue or are ready to take control of their financial future.

You may wish to include a generic piece of financial advise or two, new services/products you are providing, as well as personal team updates (births, marriages, milestones, etc.) within the newsletter’s material.

Don’t be afraid to include a personal touch. It’s easier to relate in this digital world if you add a human and personal touch.

Don’t forget to send a birthday or holiday-themed newsletter to your customers on their birthdays or holidays. This increases valuable loyalty and demonstrates that you care about them.

And, don’t worry, this process can be automated to make life easier for you.

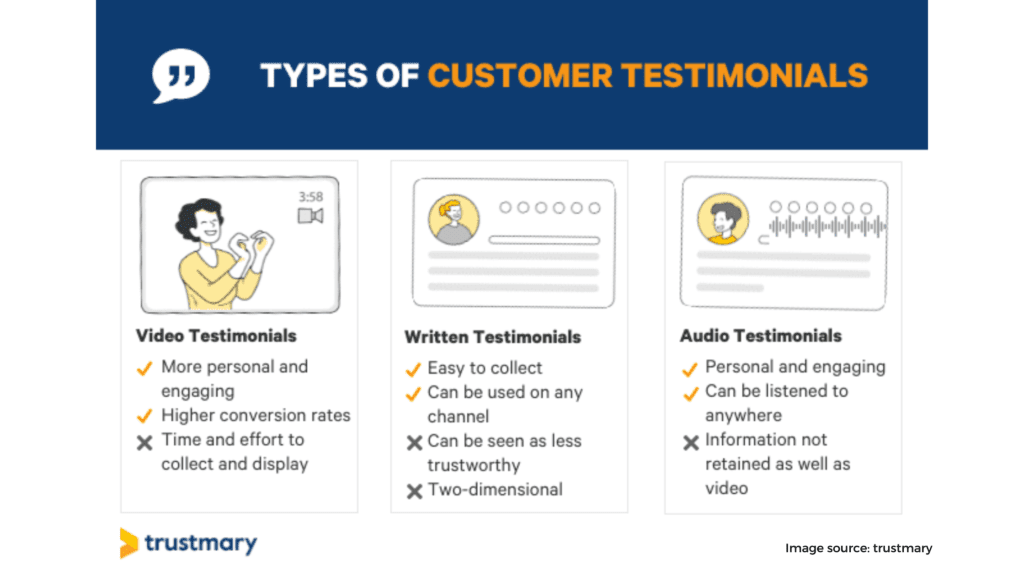

#5: Take Advantage of What Video Testimonials Can Offer

Testimonials are uncommon in the world of financial advisors and they concentrate on interconnected businesses rather than testimonials to boost their firm.

Video testimonials from happy clients, on the other hand, can be quite beneficial in promoting yourself and attracting new leads.

Why would you do this? Because video testimonials can quickly authenticate your company, which is an important first step in reaching success.

If you have pleased clients, finding someone to make a short, 30-second video testimonial about their experience with your brand should not be difficult.

Make sure to go through them after receiving them before uploading them to your website, social media, or other platforms.

If you want your video testimonials to be really professional, hire a skilled videographer to shoot and edit them.

Wrap Up: Ready to Start your Financial Advisor Marketing Strategy?

What should you do now that you’re aware of the significance of financial advisor marketing for your company, as well as some ways to achieve success?

Finally, you should look at industry experts to see what measures they are taking to develop their business.

Does it appear that they’re taking the strategies outlined above? Maybe they’re doing something else that seems to be working, as the above is not an all-inclusive list.

The secret to increasing brand awareness and generating more qualified leads is to improve your company’s performance in comparison to your competitors.