In today’s digital age, insurance agents say that social media is crucial for their business growth, with Facebook leading the pack as the most influential platform. As the insurance landscape becomes increasingly competitive, agents who harness the power of social media stand a better chance of connecting with prospective buyers and building lasting relationships.

With its 2.9 billion monthly active users, Facebook remains a dominant force in the social media world, offering unparalleled opportunities for businesses to reach and engage with their target audience. For insurance agents in the United States, Facebook isn’t just a platform for social interaction—it’s a vital marketing tool that can drive lead generation, brand awareness, and client retention. As we move into 2024, understanding how to utilize Facebook’s features and algorithms effectively is more critical than ever.

This article provides insurance agents with actionable tips to maximize their presence on Facebook in 2024. Whether your goal is to draw in new customers, retain current ones, or increase brand awareness, these strategies might assist you in staying on top of things as the digital world changes.

1. Optimize Your Facebook Business Page

Optimizing your Facebook Business Page is vital for establishing a solid online presence, especially for insurance agents looking to connect with clients in 2024. Here’s how to make sure your page stands out:

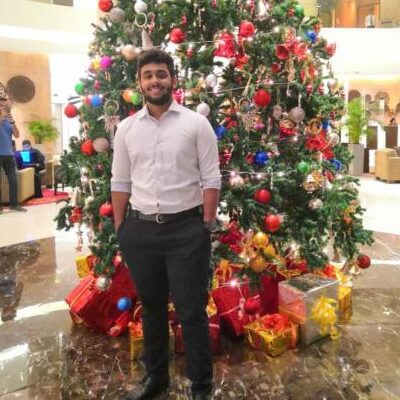

Profile and Cover Photos

When someone visits your page, they immediately notice your profile and cover photos. To create trustworthiness and a feeling of human connection, use a professional headshot as your profile picture. Select a cover photo that embodies the ideals of your brand. It could be a high-quality image of your office, a cityscape representing your location, or a graphic highlighting your services. Make sure the colors and style are consistent with your overall branding.

About Section

The About section is where potential clients learn more about who you are and what you offer. Craft a clear and concise business description that immediately conveys your value. Make use of appropriate terms that members of your target audience may use, such as “insurance agent,” “home insurance,” “life insurance,” or “coverage options.” Highlight what sets you apart from competitors—whether it’s your years of experience, specialized services, or customer-first approach. Ensure that your contact information is easy to find and up-to-date.

Call-to-Action (CTA) Button

The CTA button is one of the best tools for boosting engagement and conversions on your Facebook business page. Depending on your goals, choose a CTA that aligns with your business objectives. For insurance agents, options like “Get a Quote,” “Contact Us,” or “Learn More” are perfect. This button should lead directly to a landing page where potential clients can easily take the next step—whether that’s filling out a form, scheduling a consultation, or requesting more information.

Regular Updates

Keeping your Facebook Business Page active with regular updates is key to staying top of mind with your audience. Aim to post at least a few times a week, sharing a mix of content that educates, informs, and engages. This could include blog posts, client testimonials, industry news, or tips on choosing the right insurance coverage. Consistent updates let Facebook’s algorithm know that your page is relevant and active, which might help you show up higher in consumers’ news feeds.

By following these tips, you can create a Facebook Business Page that looks professional and effectively attracts and engages your target audience.

To know more about how to optimize your Facebook page, read the article.

This resource offers detailed advice on how insurance agents can enhance their Facebook presence.

2. Leverage Facebook Ads

Facebook Ads provide insurance agents with a powerful tool to reach and engage potential clients in 2024. Below are key strategies to optimize your Facebook advertising efforts:

Ad Formats

Facebook offers various ad formats that can cater to different campaign objectives:

- Carousel Ads: Display several products or services in a single advertisement.

- Video Ads: Engage your audience with informative and visually appealing content.

- Lead Ads: Let users fill out forms directly on Facebook to streamline the lead generation process.

Choosing the correct ad format is essential for aligning with your campaign goals. For example, carousel ads might be ideal for highlighting different insurance products, while video ads can be used to explain complex concepts like policy coverage.

Budgeting Tips

Budget management is critical for maximizing ROI on Facebook Ads. Set a budget in Facebook Ads Manager, either daily or lifetime. Facebook’s automated pacing feature will help ensure your ads are distributed evenly over your chosen time period. Additionally, experimenting with different bidding strategies, such as cost caps or highest-value bids, can optimize your spending based on your campaign objectives. Regularly monitor performance and adjust your budget to focus on the best-performing ads.

Tracking and Analytics

Facebook’s analytics tools are indispensable for tracking ad performance. Use Facebook Pixel to measure conversions and refine your targeting strategies. Key metrics to monitor include engagement, click-through, and conversion rates. By analyzing this data, you can continuously tweak your campaigns to improve results and reduce ad spend on underperforming ads.

These strategies will help you effectively leverage Facebook Ads in 2024, ensuring your campaigns are targeted, engaging, and cost-efficient.

To know more about how you can leverage Facebook Ads, read this article.

If you’re looking to combine organic content with paid strategies, this article dives into Facebook ads best practices for insurance agents.

3. Creating Engaging Content for Facebook

Educational Posts

Sharing tips, guides, and informative content establishes your agency as a trusted resource. Educational posts, such as explaining complex insurance terms in simple language or offering tips on choosing the right policy, assist in deconstructing insurance for your readers, making them more receptive to your material and inclined to believe in your knowledge.

Post regular tips on insurance-related topics, like the importance of life insurance or the benefits of bundling policies. Consider creating a series of short posts that break down common insurance myths.

Client Testimonials and Success Stories

Testimonials and success stories humanize your brand and build trust. When prospective clients see real-life examples of how you’ve helped others, they are more likely to trust you with their own insurance needs.

Share short, authentic stories from satisfied clients. Pair these stories with high-quality images or videos to make them more compelling. Make sure to highlight the specific benefits the client experienced from working with your agency.

Interactive Content

Interactive content like polls, quizzes, and live videos engage your audience more deeply than static posts. They encourage participation and can increase the visibility of your content due to higher engagement rates.

Create polls that ask your audience about their insurance preferences or concerns. Host live Q&A sessions where you answer common insurance questions. Quizzes that assess a person’s insurance knowledge or needs can also be both fun and informative.

Content Calendar

Retaining exposure and interaction on Facebook requires consistency. A content calendar helps ensure that you’re posting regularly and at optimal times, which can increase your reach and engagement.

Plan your posts at least a month in advance. Use a calendar to schedule posts on different topics throughout the week. To maintain a lively and captivating feed, including a blend of informative articles, user reviews, and interactive postings.

By following these guidelines and utilizing the strategies outlined in the related articles, you can create a strong Facebook presence that engages your audience and drives business growth.

4. Utilizing Facebook Groups for Insurance Agents in 2024

Join Relevant Groups

Insurance agents should actively participate in Facebook groups where their target audience frequents. These groups provide a space to connect with potential clients over shared concerns like life insurance needs, financial planning, or healthcare options. When you participate in these groups, you can answer questions, share insights, and build trust with group members, leading to organic lead generation. Following the group’s rules and providing value without being overly promotional is also essential.

Create Your Own Group

Creating a Facebook group specifically for your clients and prospects allows you to build a community around your brand. This group can serve as a hub for discussions on insurance-related topics, updates on policy changes, and exclusive content that positions you as a thought leader in the industry. Members should feel free to share their stories and ask questions in the group. This will promote a feeling of community and brand loyalty.

Engagement Strategies

To keep your Facebook group lively and interested, post insightful stuff regularly, such as news from the business, advice, and learning materials. Hosting live Q&A sessions or webinars within the group can further enhance engagement and provide members with real-time information. Furthermore, you can customize your services to fit the demands of your audience by using polls, surveys, and interactive postings to comprehend their needs and preferences on a deeper level.

5. Use Facebook Messenger for Direct Communication

Chatbots: Automate Your Responses

Chatbots are invaluable for insurance agents looking to streamline customer service on Facebook Messenger. These AI-powered assistants can handle routine inquiries, such as quoting requests, appointment scheduling, and policy information, without the need for human intervention. Setting up chatbots ensures that clients receive instant responses to their questions, enhancing their experience and freeing up your time to focus on more complex tasks. The secret is creating the chatbot to respond to the most common queries clearly and concisely, ensuring it reflects your brand’s tone and professionalism.

Personalized Outreach: Connect on a Personal Level

While automation is powerful, personalized communication remains crucial, especially in the insurance industry, where trust is a significant factor. Facebook Messenger allows you to send tailored messages directly to leads, providing a more personalized approach. Whether you’re following up on a lead from a recent inquiry or reaching out to existing clients with updates on their policies, Messenger offers a less formal but highly effective channel to connect. Make your correspondence more individualized by using the client’s name, referencing their specific needs or past interactions, and offering solutions that cater directly to them.

Lead Nurturing: Guiding Clients Through the Sales Funnel

Lead nurturing is critical to converting prospects into clients, and Facebook Messenger can play a vital role in this process. Use Messenger to follow up with leads after their initial contact, whether through automated sequences or personalized messages. Provide them with instructional materials, including articles or videos that describe various insurance products, and don’t forget to remind them of deadlines or policy renewals. By providing ongoing value through Messenger, you keep your leads engaged and more likely to choose your services when they decide. Additionally, since Messenger is more personal and immediate than email, it often has higher open and response rates, making it a potent tool in your lead nurturing strategy.

To know more about how to use Facebook messenger, read this article.

6. Run Facebook Contests and Giveaways

As an insurance agent, holding freebies and contests on Facebook is a great way to increase reach and enhance engagement. These campaigns can attract new followers, generate leads, and even turn participants into loyal clients. Here’s how you can effectively run Facebook contests and giveaways while staying compliant with platform rules:

Engagement Boost

Facebook contests and giveaways are known for significantly increasing engagement. By offering a prize, you incentivize people to interact with your page. Engagement through likes, shares, comments, and tags not only spreads your content to a wider audience but also improves your page’s visibility due to Facebook’s algorithm favoring interactive content.

Example: A simple contest asking followers to share their best insurance-saving tip in the comments can create a buzz, leading to higher interaction rates.

Compliance with Facebook Rules

It’s essential to ensure your contest complies with Facebook’s guidelines to avoid any penalties or removal of your contest post. Facebook has specific rules regarding promotions, which include:

- Clear Terms and Conditions: Always provide clear contest rules, eligibility requirements, and terms and conditions. For example, specify the entry method (e.g., like and comment on the post) and mention that Facebook is not associated with the contest.

- No Tagging Requirements: Facebook prohibits contests that require participants to tag themselves or others in a photo where they’re not present. Instead, encourage sharing or commenting as a way to enter.

- Avoid Misleading Promotions: Ensure that your prize is relevant to your audience and valuable enough to incentivize participation but not misleading in its representation.

By adhering to these guidelines, you continue to have a solid rapport with both the platform and your audience.

Prizes and Incentives

Choosing the right prize is crucial to the success of your contest. The prize should be relevant to your audience and ideally tie into your services as an insurance agent. For example, offering a free insurance consultation, a discount on insurance premiums, or a gift card to a popular retailer can be attractive incentives.

- Consider the Audience: Know your target demographic. For instance, a younger audience might appreciate a gift card to a trendy online store. At the same time, older participants might be more interested in a discount on a home or auto insurance policy.

- Highlight the Benefits: When promoting the contest, emphasize how the prize can benefit the winner. For example, “Win a free one-on-one insurance consultation to ensure your family’s financial future is secure!”

Instill a sense of urgency in your followers to encourage participation. Limited-time offers or a countdown to the contest’s end can increase participation rates.

7. Leverage Facebook Insights and Analytics

Understanding Your Audience

Facebook Insights provides an abundance of information about your audience, helping you understand who engages with your content and how they interact with it. By analyzing demographic data—such as age, gender, and location—you can tailor your posts to better resonate with your target audience. For example, suppose you discover that a significant portion of your audience comprises millennials. In that case, you might focus on creating content that appeals to their interests, such as tips on digital insurance tools or the importance of financial planning in their 30s.

Post Performance

Analyzing which posts perform best is crucial for refining your content strategy. Facebook Insights allows you to see how each post performs regarding reach, engagement, and clicks. Pay attention to patterns—what types of content get the most likes, shares, and comments? Are your audience members more engaged with video content, or do they prefer infographics? By identifying these trends, you can focus on creating more of what works and less of what doesn’t.

Adjusting Strategy

The insights you gather should inform your ongoing marketing strategy. If you notice that posts made at certain times of the day receive higher engagement, adjust your posting schedule accordingly. Likewise, if you see that certain topics or content types consistently underperform, it may be time to rethink your approach. Regularly reviewing your Facebook Insights ensures that your strategy evolves based on real-time data, leading to better outcomes and a more engaged audience.

To read more about how to use Facebook Analytics, you can read this article.

This resource is perfect for insurance agents looking to leverage analytics to improve their marketing efforts.

8. Incorporate Video Marketing

In 2024, video content remains one of the most powerful digital marketing tools; it’s a game-changer for insurance agents. Here’s how to use Facebook video marketing to engage viewers and build relationships.

Live Videos

Using live videos can allow you to interact with your audience in real time. Hosting live Q&A sessions allows you to address potential clients’ questions about insurance, build trust, and position yourself as an expert in the field. Consider scheduling webinars on topics like “Understanding Your Life Insurance Options” or “The Basics of Home Insurance.” Additionally, you can offer a behind-the-scenes look at your agency, giving a human touch to your brand and making it more relatable.

Example: “Join us this Thursday at 6 PM for a live Q&A session on everything you need to know about auto insurance. Get your questions answered live!”

Explainer Videos

Short, informative videos that break down complex insurance topics can be incredibly effective. Create explainer videos that discuss various insurance products, such as “What is Term Life Insurance?” or “How Does Homeowners Insurance Work?” These videos educate your audience and help them make informed decisions, ultimately driving conversions. Keep the videos concise, engaging, and visually appealing to quickly capture the viewer’s attention.

Example: “Check out our latest video explaining how disability insurance works and why it might be the right choice for you.”

Storytelling

People connect with stories, and storytelling through video is a compelling way to build emotional connections with your audience. Share success stories of clients who were saved by having the right insurance coverage or create scenarios that illustrate the importance of being insured. Storytelling humanizes your brand and helps potential clients see the real-world impact of insurance, making it more relatable and memorable.

Example: “Watch this heartwarming story of how our insurance policy helped a family rebuild their lives after a devastating fire.”

Incorporating video marketing in your Facebook strategy improves audience engagement and fosters closer ties with them. Video material, whether explainers, live videos, or narrative, may greatly increase your exposure and reputation in the insurance industry.

9. Promote Client Reviews and Testimonials

Encouraging Reviews

Client reviews are more than just feedback—they’re powerful tools that can significantly impact your business’s credibility and appeal. As an insurance agent, seeking out reviews from satisfied clients is essential. After successfully assisting a client, follow up with a simple request for a review on your Facebook page. You can automate this process by integrating it into your customer follow-up emails or text messages. Provide a direct link to your Facebook review section to make it as easy as possible for clients to share their experiences. Remind them that the community members in their area benefit from their input when making decisions concerning their insurance requirements.

Showcasing Testimonials

Once you’ve accumulated positive reviews, don’t let them just sit unnoticed on your page—showcase them! Feature glowing testimonials in your Facebook posts and ads to build trust and authenticity. You can create visually appealing posts with quotes from satisfied clients, accompanied by their photos (with permission) or relevant imagery. Highlight specific aspects of their review that underscore your strengths, such as exceptional customer service, comprehensive coverage options, or quick claims processing. Regularly sharing testimonials reinforces your credibility and serves as social proof that can influence potential clients who are considering your services.

10. Staying Updated with Facebook Algorithm Changes

In 2024, staying ahead of Facebook’s algorithm changes is crucial for maintaining content visibility and engagement. The Facebook algorithm has evolved to prioritize content that fosters meaningful interactions, emphasizes quality, and aligns with user preferences. Here’s how you can adapt:

Understand the Algorithm’s Focus on Engagement

Facebook’s 2024 algorithm update places significant weight on content that generates meaningful interactions, such as comments, shares, and reactions. This means your posts should aim to spark conversations and emotional responses. Content that resonates deeply with your audience, such as client testimonials or engaging questions related to insurance, is more likely to be favored by the algorithm.

Embrace Quality Over Quantity

Although it could be tempting to post often, the algorithm now prioritizes content quality above quantity. Invest time in creating well-crafted posts that offer real value to your audience. High-quality, original content that educates or entertains your audience will likely see better reach and engagement.

Diversify Your Content Formats

The algorithm favors diverse content types, especially videos and interactive posts. Incorporating videos, particularly live videos, into your strategy can boost visibility. Additionally, using polls, quizzes, and other interactive elements can help keep your audience engaged.

Leverage Facebook Insights and Analytics

Keep a close eye on Facebook Insights to see what kinds of material your audience responds to the most. Using this data-driven approach, you may improve your plan of action and ensure that your content aligns with what your audience finds valuable.

Stay Informed and Adaptable

Algorithm updates are continuous, so staying informed about the latest changes is essential. Engage with industry news, participate in digital marketing forums, and follow Facebook’s own updates to ensure you’re always on top of new developments.

Concentrating on these methods may help insurance agents improve their Facebook marketing efforts and ensure that their material is seen and engaged even with the ever-changing algorithm.

To know more about how to stay updated with Facebook Algorithm, read this article.

Remember the essential tips we’ve covered: optimizing your Facebook Business Page, leveraging Facebook Ads, and creating engaging content are foundational. Engaging with Facebook Groups, using Messenger for direct communication, and running contests can significantly enhance your reach and client interaction. Don’t forget the power of video marketing and promoting client reviews to build credibility. Lastly, maintaining visibility and effectiveness is crucial to staying updated with Facebook’s ever-evolving algorithm.

The moment is ripe to begin implementing these methods. Whether you’re new to Facebook marketing or looking to refine your existing approach, these tips will help you connect more effectively with your audience and grow your insurance business. Take action today, and watch as your Facebook presence transforms into a powerful client acquisition and retention tool.

Facebook is continuously evolving, and so should your strategies. If you keep up with the latest trends and are open to trying out novel strategies, you’ll be in a good position to succeed in 2024 and beyond. Keep learning, keep experimenting, and keep connecting with your audience in meaningful ways.